Selling a business or generating liquidity through a dividend recapitalization offer business owners the opportunity to turn years of work into an enduring financial legacy. However, planning with a wealth advisor must begin far in advance of the business transaction to realize the greatest wealth benefits. The following is a case study showing how the right approach to wealth planning can result in substantial gains.

Client background: Maria and her husband, Thomas, founded a biotechnology company in 2004, and today their shares in the private company have a book value of $10 million. However, the company’s investment bankers project that if the company were acquired by a strategic buyer in a competitive process, the shares would be worth $100 million. Maria and Thomas, who have three children, have an additional $15 million in other assets and no debt.

Client priorities: Because Maria and Thomas have accumulated enough wealth outside of the company’s stock to support their lifetime spending needs, their primary goals are:

- Passing wealth to their three children in a tax-efficient manner

- Supporting several charities and giving their children an opportunity to be involved in deciding which charities to support

- Minimizing income and estate taxes

Recommended strategy: To accomplish these goals, their wealth advisor recommends transferring 30% of the company stock ($3 million based on the stock’s pre-transaction book valuation) to trusts for the children and another 30% to a donor-advised fund (DAF) for charitable giving before the transaction closes.

By transferring the stock to the children’s trust, any subsequent appreciation in its value will be excluded from the couple’s taxable estate. By making the transfer to the DAF, they avoid paying capital gain tax on that portion of the stock. They will also receive a charitable income tax deduction, which will make the sale transaction more tax efficient. Maria and Thomas plan to fund their future charitable giving from the newly created DAF and incorporate the DAF into their estate plan.

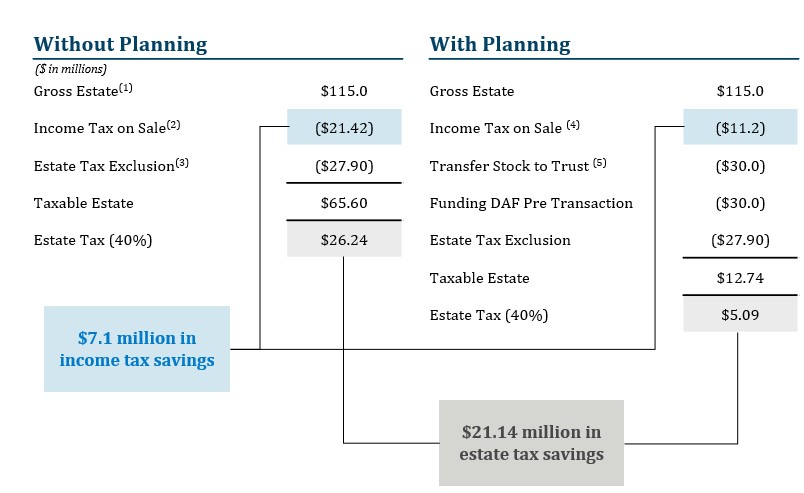

Projected outcome: As depicted in the projection below, these effective pre-transaction planning strategies are projected to save Maria and Thomas $7.1 million in income taxes on the sale and $21.14 million in estate taxes.

Illustrative Proceeds Maximization Case Study

Proper planning allows for substantial tax savings

- Situation: Founder / shareholder to receive $100 million in proceeds from a transaction

- Objective: Intends to donate roughly one third to charity over lifetime, one third to children

(1) Assumes shareholder has $10mm basis in company and value of $100mm at the time of the transaction. Also assumes that shareholder has $15million in other assets.

(2) Assumes 20% Long Term Gain Tax on $90 million plus Medicare Surtax at 3.8%.

(3) 2025 estate tax exclusion amount is $13,990,000 per individual.

(4) Assumes avoiding $27 million realized cap gain and obtaining a fair market value charitable deduction for 30% of company stock transferred to DAF pre transaction.

(5) Post transaction value off stock transferred to Children’s trusts through a grantor retained annuity trust ($3mm pre-transaction value).