U.S. equity markets posted strong gains in the fourth quarter with multiple indexes reaching record highs to end the year. This capped one of the strongest years for stocks in the past decade. Several factors helped boost stock prices throughout 2019, including accommodative monetary policy globally, easing trade tensions between the United States and China, greater certainty around Brexit following a Conservative majority victory in December’s general election, and encouraging economic data related to consumer confidence and employment.

The S&P 500 (up 28.9% for the year and 8.5% for the fourth quarter) and Nasdaq (up 35.2% for the year and 12.2% for the quarter) both logged their strongest yearly performance since 2013. Information Technology was the best-performing S&P sector, up 48.0% for the year, followed by Communication Services up 30.9%. Energy was the worst-performing sector, up 7.6%, followed by healthcare up 18.7%. The Dow Jones Industrial Average gained 22.3% for the year and 6.0% for the quarter, and the Russell 2000 small-cap index gained 23.7% for the year and 9.5% for the quarter.

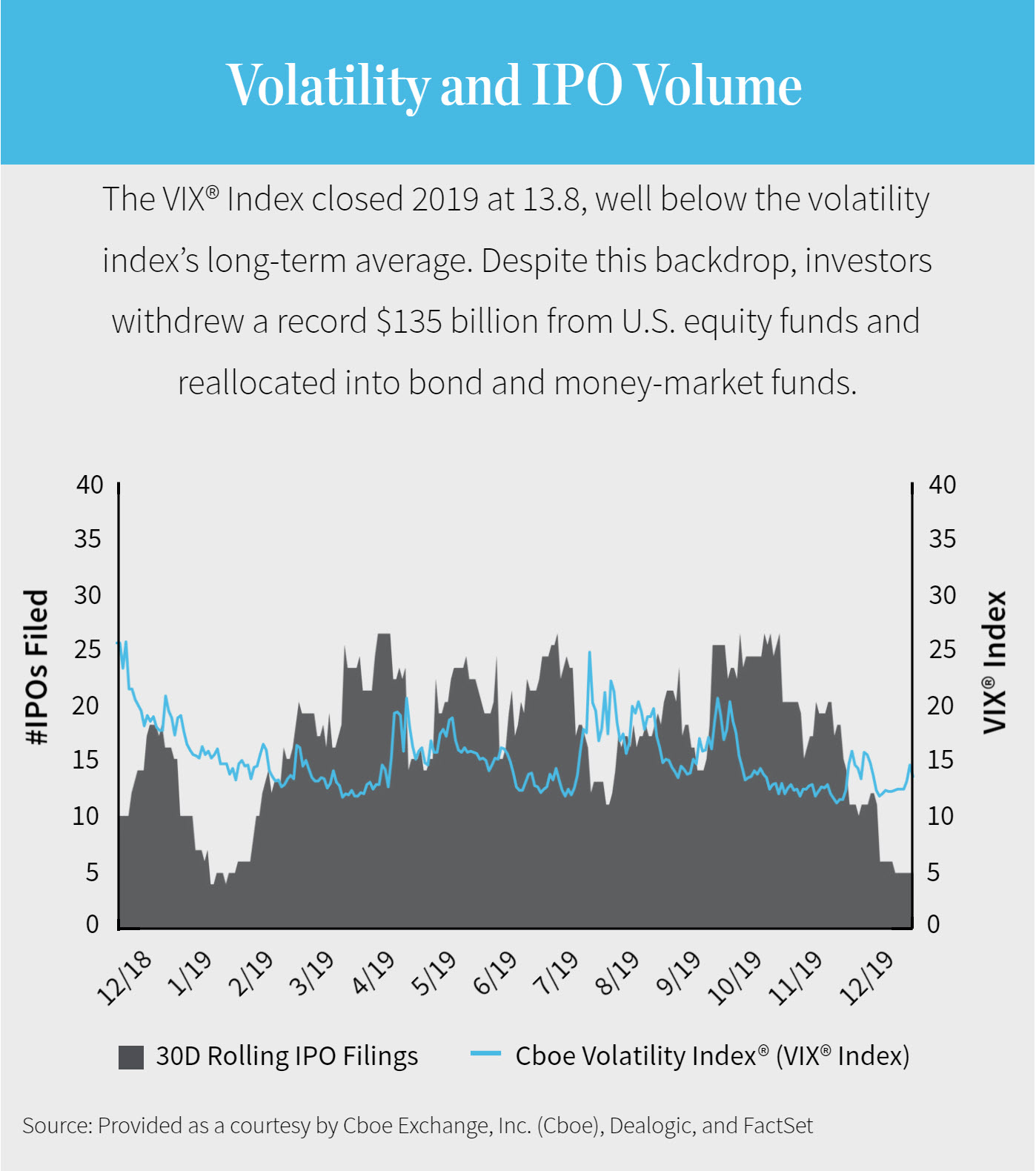

These gains came despite a sharp decline in corporate buybacks and continued outflows from equity funds. More than $135 billion was withdrawn from U.S. equity funds in 2019, the largest withdrawal on record, as investors seeking save havens from volatility shifted to bond and money-market funds. More than $220 billion was pulled from actively managed funds in 2019, continuing a multi-year shift toward passive management. In September, assets in passive equity funds overtook active funds for the first time on record.

Highlights include:

- IPO volume falls, total proceeds hold steady for the year

- Investors refocus on profitability after several disappointing high-profile debuts

- Multiple next-generation consumer companies poised to join pipeline in 2020

- Convertible debt offerings surge to highest level in more than a decade

- 2020 outlook: U.S. presidential election to influence IPO timelines