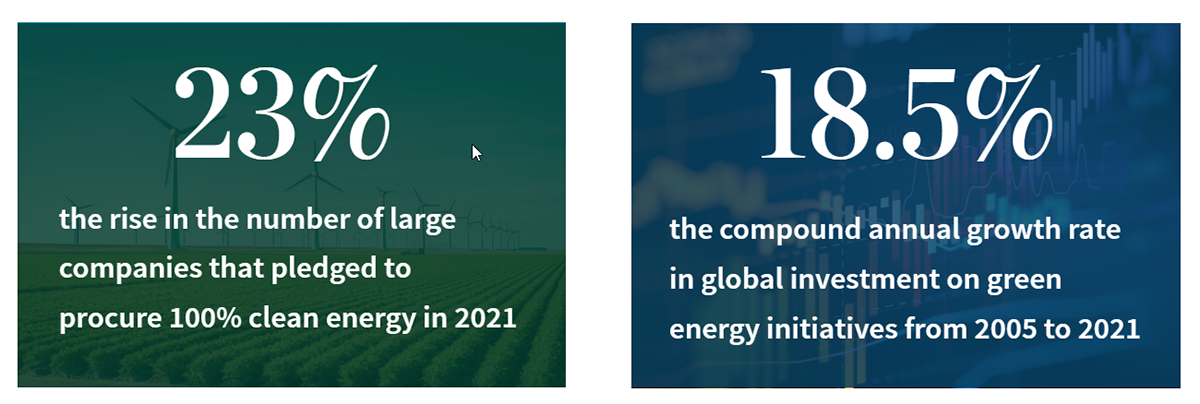

Environmental, social, and governance (ESG) has become a hot topic within both the political and investing world, yet it continues to gain traction as corporations and governments are allocating more resources to the cause. According to the 2022 Sustainable Energy in America Factbook, the number of large companies that pledged to procure 100% clean energy rose 23% in 2021 to 351 organizations. Further, the study estimates that global investment on green energy initiatives has increased at an 18.5% compound annual clip to $755 billion in 2021 (versus $50 billion in 2005) including U.S.-based investment growing at a 17% compound annual clip to $105 billion (versus $9 billion in 2005).

The focus on ESG within the payments industry is no different. According to a blog post from Mastercard CEO Michael Miebach in 2021, in an effort to “accelerate progress toward our sustainability goals,” Mastercard began to link incentive compensation for senior leaders (i.e., executive vice presidents and up) to various ESG priorities: carbon neutrality, financial inclusion, and gender pay parity, and in 2022 Mastercard began to link bonus calculations for every employee to various ESG goals. More broadly, we believe ESG efforts within the payments industry can help reduce costs and drive meaningful societal change.

In our report ESG Insight: Exploring ESG Dynamics Within the Payments Industry, we reviewed various ESG metrics and initiatives across six payments companies: FIS, Fiserv, Global Payments, Mastercard, PayPal, and Visa. While all ESG topics are important, we primarily focused on a few key areas: 1) energy and emissions; 2) financial inclusion; 3) data security and protection; and 4) workforce diversity, equity, and inclusion. We provide a broad overview on these topics, highlight various internal ESG efforts, and provide comparisons between companies (and select leaders in other industries), when possible.

Our work suggests that payments companies represent a unique opportunity for ESG-focused portfolios. Some of the more interesting takeaways from our analysis include: 1) payments companies tend to have lower emissions intensity versus other leading companies within select industries (e.g., healthcare, retail/consumer, and technology); 2) electronic transactions generally require much less energy per transaction versus paper currency (or Bitcoin); 3) payments companies are in a unique position to help drive financial inclusion and promote data security/protection—two pillars of ESG investing; and 4) payments companies in our sample had a more racially diverse workforce (versus the industry and U.S. workforce).

We note that ESG reporting standards continue to evolve and disclosures vary by company, which makes comparing companies and industries difficult. Nonetheless, we believe this report will provide a framework for investors interested in ESG and the payments sector.

For a copy of the “ESG Insight: Exploring ESG Dynamics Within the Payments Industry” report mentioned in this article or information on any of the companies in Cris Kennedy’s and Bob Napoli’s research coverage list, please contact your William Blair salesperson.