While the recent surge in sustainable investing has been most often linked with equities, the creation of green and sustainable bonds has added fixed income to the choices for ESG-minded investors.

"Because of its focus on long-term cash flows and the sustainability of the underlying business, fixed-income investing may lend itself even better to ESG and sustainable investment themes than equities," says Todd Kurisu, a portfolio manager with William Blair investment management's fixed-income team. Kurisu is also on IM's ESG working group, which helps guide development of sustainable investing initiatives.

Companies and municipalities are issuing an increasing number of bonds tied to their specific environmental and sustainable initiatives. Such green bonds gained popularity in the European Union with the first such security issued by the European Investment Bank in 2007, with the proceeds used to finance clean energy projects.

Now such bonds are being issued by investment-grade entities targeted at a myriad of environmental goals but also at ESG-related social causes.

Starbucks has been a pioneer in this space. In 2016 it was the first company to issue a sustainable bond (10-year, $500 million) to promote sustainable farming practices. In May 2019 the company issued its third and largest sustainable bond (30-year, $1 billion), which will further support a sustainable coffee production chain, providing debt financing to coffee farmers in Latin America, Africa, and Asia.

Starbucks led and others followed, Kurisu says. South American pulp producers issued bonds in 2016 and 2017 to finance sustainable forestry, water, and energy management. Also in 2017 banking giant HSBC widened the ESG horizon by issuing a green bond to finance loans that target measurable sustainability projects in healthcare, education, and civil infrastructure.

The institutional market is on board and wants sustainable investments. It's going to happen and now that fixed-income investors are embracing it, it's only going to get bigger.

TODD KURISU, William Blair Portfolio Manager

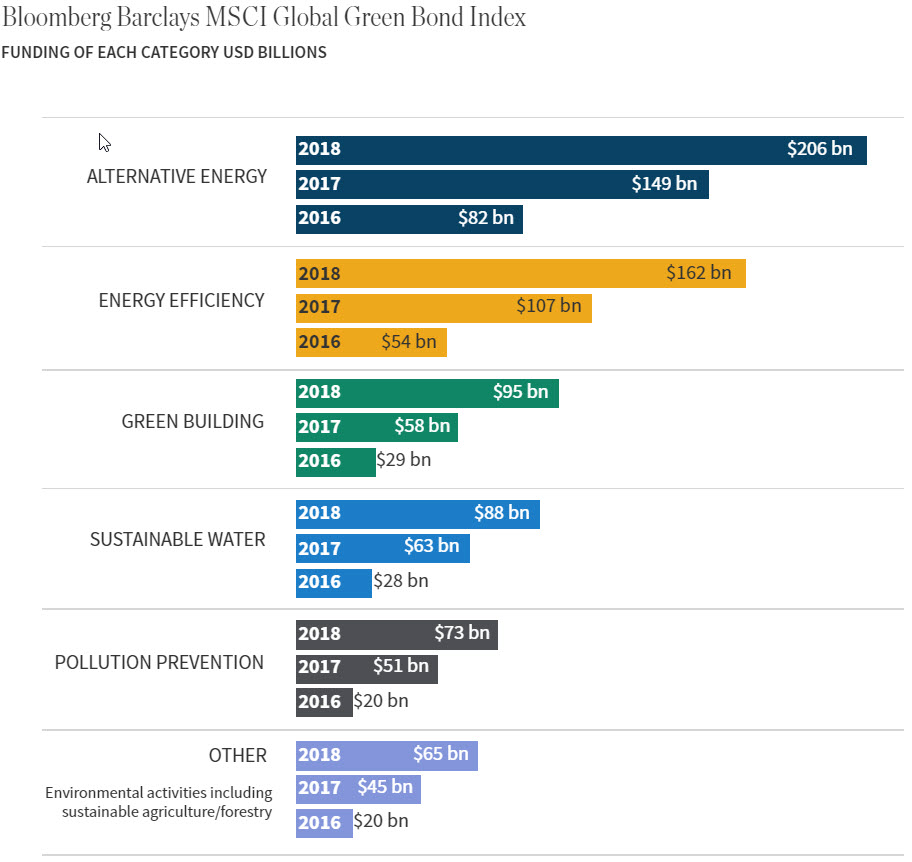

That trend is reflected in the Bloomberg Barclays MSCI Green Bond Index, an industry benchmark comprising fixed-income securities issued to fund projects with direct environmental benefits. Total funding in the index surpassed $240 billion in 2018. Outstanding debt for environmental initiatives such as sustainable forestry and agriculture, for example, has risen 221% in the past two years while energy-related bonds were up 170%.

"Historically, municipalities issued green bonds to fund new buildings or upgrade existing buildings to increase energy efficiencies," says Kurisu. "Today, it’s corporations driving the change issuing big global deals."

The HSBC bond, geared to finance targeted "green" loans, exemplifies the boost that the theme of sustainability is giving to Wall Street finance. Loan terms can be tied to the borrower's ability to meet environmental or sustainable targets like reducing fossil fuels or increasing sustainability goals.

Kurisu expects the trend toward both green bonds and targeted green loans to grow. Commodity trader COFCO in July 2019 signed a $2.1 billion loan, China’s first sustainability-linked loan.

William Blair IM's fixed-income team launched a sustainable fixed-income strategy last year.

"The institutional market is on board and wants sustainable investments," Kurisu adds. "It's going to happen and now that fixed-income investors are embracing it, it's only going to get bigger."