Retailers and food manufacturers are adapting to changing consumer preferences and focusing on their ability to reach customers digitally. Large CPG food and beverage companies, many of which have outperformed the broader equity market, are flush with cash and eager for growth, suggesting a potential increase in M&A activity in the near term. Meanwhile, some segments outside of retail and packaged foods are holding strong or experiencing growth.

This report is the latest in our series of updates on the food and beverage industry (see our previous reports from March 26 and April 9). In this issue, we focus on three emerging themes based on our real-time conversations with operators and investors from across the food and beverage industry in the second half of April.

- Digital coupons become more important than ever for retailers

Historically, in-store marketing has been the linchpin of food retailers' and manufacturers' promotional efforts. The growth of online-enabled grocery shopping amid the pandemic, however, is forcing retailers and manufacturers to pivot to an emphasis on digital marketing.

As consumers increasingly turn to online-enabled options for grocery shopping, including "click and collect" and home-delivery services, digital couponing and broader digital marketing efforts have become vital to capturing and maintaining market share. Retailers are asking brands to develop digitally delivered promotions to help them maintain new shoppers gained during panic buying.

Online grocery shopping has lower switching costs because consumers can easily compare prices and search for particular items across several stores; as a result, retailers are increasingly requesting that manufacturers offer promotions that are unique to their banners. Although food manufacturers did not need promotions to move product in the early stages of the pandemic, the need to drive sales will increase as we move toward a recession. As consumers become increasingly price sensitive, retailers will rely on digital coupons and promotions to communicate savings to lure households into their stores.

In the past several weeks, we have heard that many retailers and brands have transitioned almost all of their marketing budgets to focus on online mediums. Retailers and manufacturers must determine how to get the right promotions in front of the right consumers at the right time in the online buying journey. Digital promotions will come from a variety of channels—including manufacturers' and retailers' websites, social media, branded apps, email distribution lists, and online advertisements. While these efforts have always defined digital marketing, COVID-19 has created an inflection point in online-enabled grocery penetration. CPG producers that were early adopters of digital marketing have a significant advantage, while others are scrambling to catch up.

- Encouraging backdrop for strategic acquisitions in packaged food and beverage

Large CPG food and beverage producers are well positioned and incentivized for acquisitions over the medium term. Elevated sales, increased operating leverage, and reduced trade spend are driving significant cash flow generation that can be used for M&A. At the same time, many large CPG producers are operationally hamstrung in their abilities to roll out innovations; all production capacity is being used to keep up with elevated demand, which limits line time for new product development. In addition, retailers are sorting through a period of rapid change, limiting some producers' abilities to get new products slotted. Without this ability to innovate, we expect strategics to look to M&A to both invest their growing cash balances and actively reshape their portfolios.

We also expect strategics in this space to continue making acquisitions related to the mega trends of better-for-you, clean label, and plant-based products. While the pandemic is reshaping many aspects of consumers' lives, their values with regard to food have remained relatively unchanged. The two nuances to this view are an increase in the importance of meals and meal prep, and the increased need for value-priced products and brands.

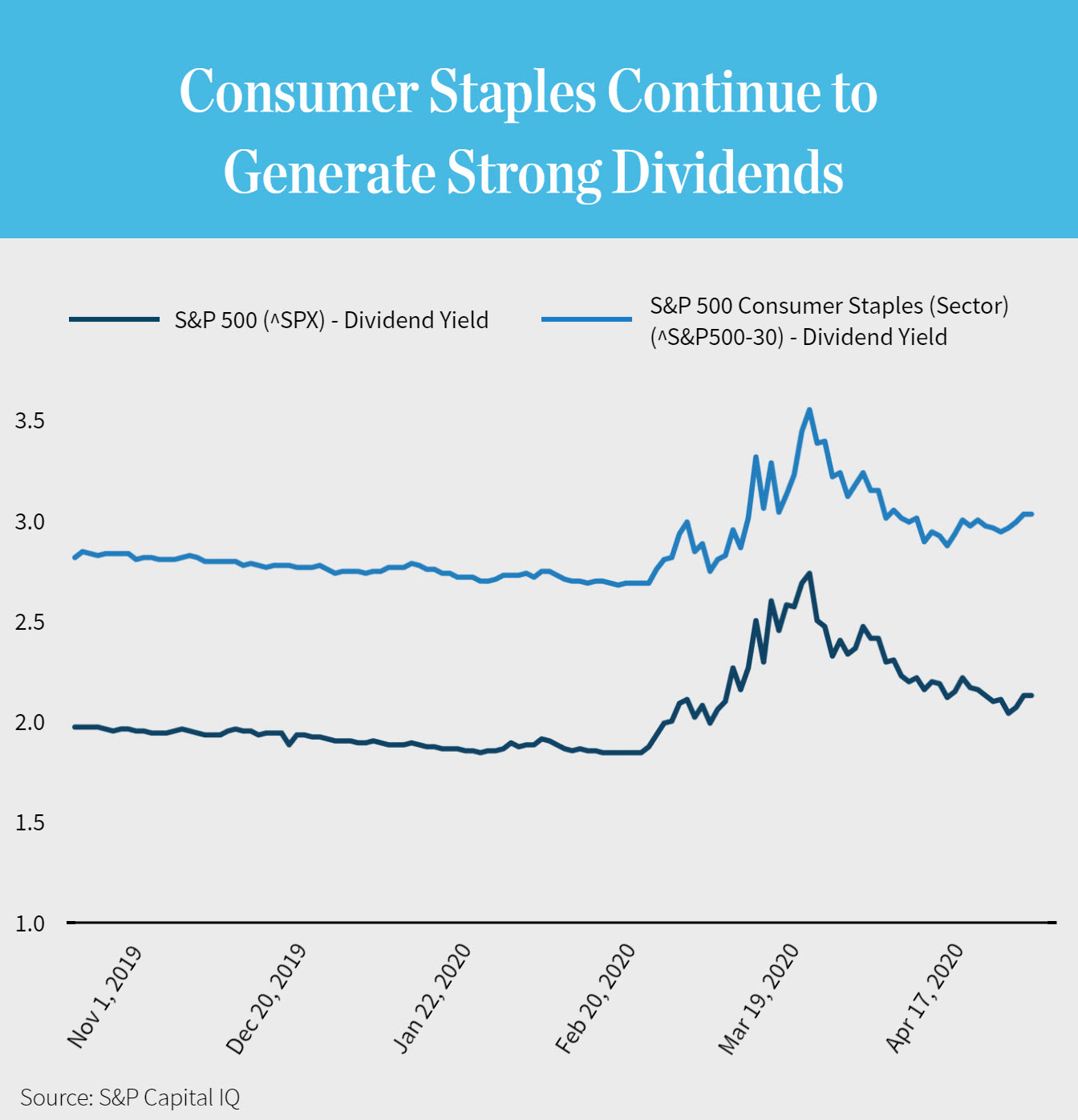

Despite the much-publicized surge in packaged food and beverage sales in March and April, valuations for the industry's publicly traded companies still appear attractive from an investment perspective as of early May. These companies typically generate strong cash flow and provide attractive dividend yields. With producers expecting increased cash flows throughout the pandemic, strategic acquirers are well positioned to explore M&A opportunities while maintaining strong dividend yields.

- Bright spots in foodservice

The challenges that face businesses catering to food away from home have been widely covered during this crisis. However, the pandemic has created opportunities for companies focused on direct-to-consumer distribution, as well as some aspects of the institutional foodservice markets in healthcare and education.

Prepared meals and meal kit companies, such as HelloFresh and Blue Apron, have seen an increase in demand during this crisis. HelloFresh reported a year-over-year revenue increase of 66% for the first quarter and a 68% increase in active customers. The German meal-kit maker said that the surge in pandemic-related volume in March came on the heels of strong performance in January and February. Blue Apron, however, struggled to keep up with increasing demand in late March, reporting first-quarter revenue and EBITDA results that were softer than expected. The company reported further increases in orders in early April and has been focused on adding headcount to complete orders due to heightened demand. While there is clearly strong demand and lift driven by COVID-19, the divergent results among meal-kit makers creates questions about the long-term viability of some of these business models.

Direct-to-home meal providers that are related to healthcare services are experiencing strong growth amid the pandemic. Medicare, Medicaid, many private insurance plans, as well as services such as Meals on Wheels offer meal benefits that provide necessary nutrition to seniors and other at-risk populations while keeping them safe at home. To succeed, these companies not only need to have meal solutions that cater to a variety of need states, they also need to make meaningful investments in logistics and distribution networks. Foodservice providers that are catering to these healthcare end-markets are seeing a strong increase in demand that has the potential to be sustainable even as this crisis subsides.

While many K-12 schools have been forced to shut down and move to remote learning during the COVID-19 crisis, many school meal programs continue to operate. When schools are closed, meal service does not need to occur, but districts across the nation have decided to provide essential nutrition to millions of American children on a daily basis. For many children in lower-income families, school meals are their only reliable source of nutrition. This continuation of meal service has been an important social mission for many school food producers, and while it may not completely offset the total number of meals served in a regular school year, it demonstrates the vital need for school foodservice in our communities.

Many additional themes that merit close attention will emerge as the COVID-19 response evolves. We will continue to closely monitor these developments through our ongoing conversations with business leaders and teams at the frontlines of the food and beverage industry, as well as with the investors and analysts who focus on this critical part of the global economy.

If you have any questions about these themes and what they mean for your business, please do not hesitate to contact us.