Determining the relationship between annual lifetime spending and remaining wealth is extremely valuable. Before you think about wealth-transfer or philanthropic opportunities, you must first determine your annual lifetime spending needs.

Quantifying your lifetime spending includes budgeting for annual recurring needs as well as any large purchases, such as vacation homes, boats, and travel.

Consider the example of a business owner who receives $40 million in after-tax proceeds from selling his business at age 55 and then invests the proceeds in a diversified portfolio.

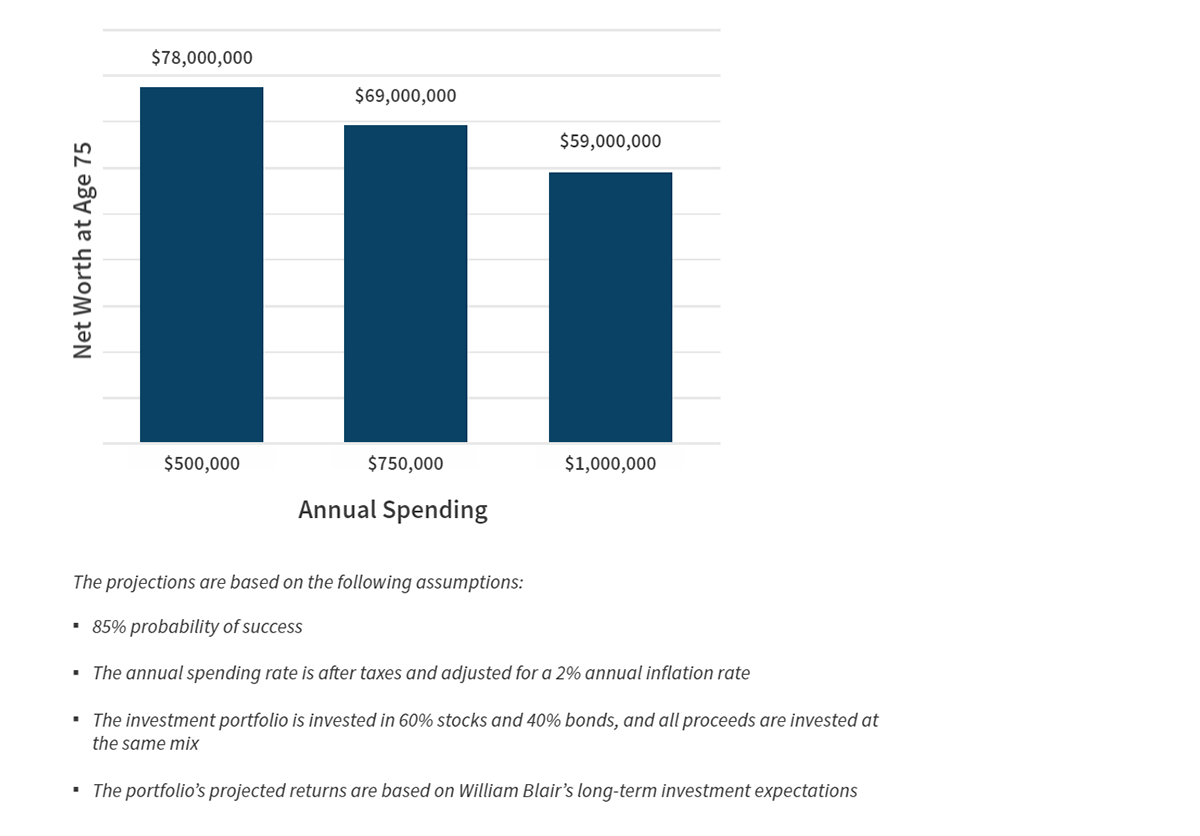

If the client spends $500,000 annually, he is projected to have $78 million remaining upon reaching age 75. If the owner instead spent $750,000 annually on his lifestyle needs, his projected net worth at age 75 would be $69 million, and if the owner spent $1 million annually on his lifestyle needs, his projected net worth at age 75 would be $59 million.

A 55-year-old business owner’s projected net worth at age 75 based on $40 million in after-tax proceeds and various annual spending levels.