The bond market looks a lot different today than it did a year ago.

Yields are up significantly—a reflection of the Federal Reserve’s sharp interest rate hike to cool inflation over the past year—enabling bonds to play their traditional role of providing income for those who buy and hold fixed-income securities to maturity.

Since the Fed began raising its target interest rate last year, rates have jumped to a 5%-5.25% range from near zero in March 2022, the fastest pace of increase in four decades.

The rate hike cycle has impacted and continues to impact how investors are analyzing risk/reward trade-offs. Last year, the Fed’s aggressive increase weighed on the value of bond portfolios, given the inverse relationship between the price and yield of bonds.

“Historically, bonds as an asset class can and do provide a level of stability in investors’ strategic portfolios, particularly high-quality bonds,” says Tyler Glover, director of William Blair Consulting Services. “Even as difficult as last year was for bond investors, we are at a point where investors are getting more reasonably compensated by way of yields.”

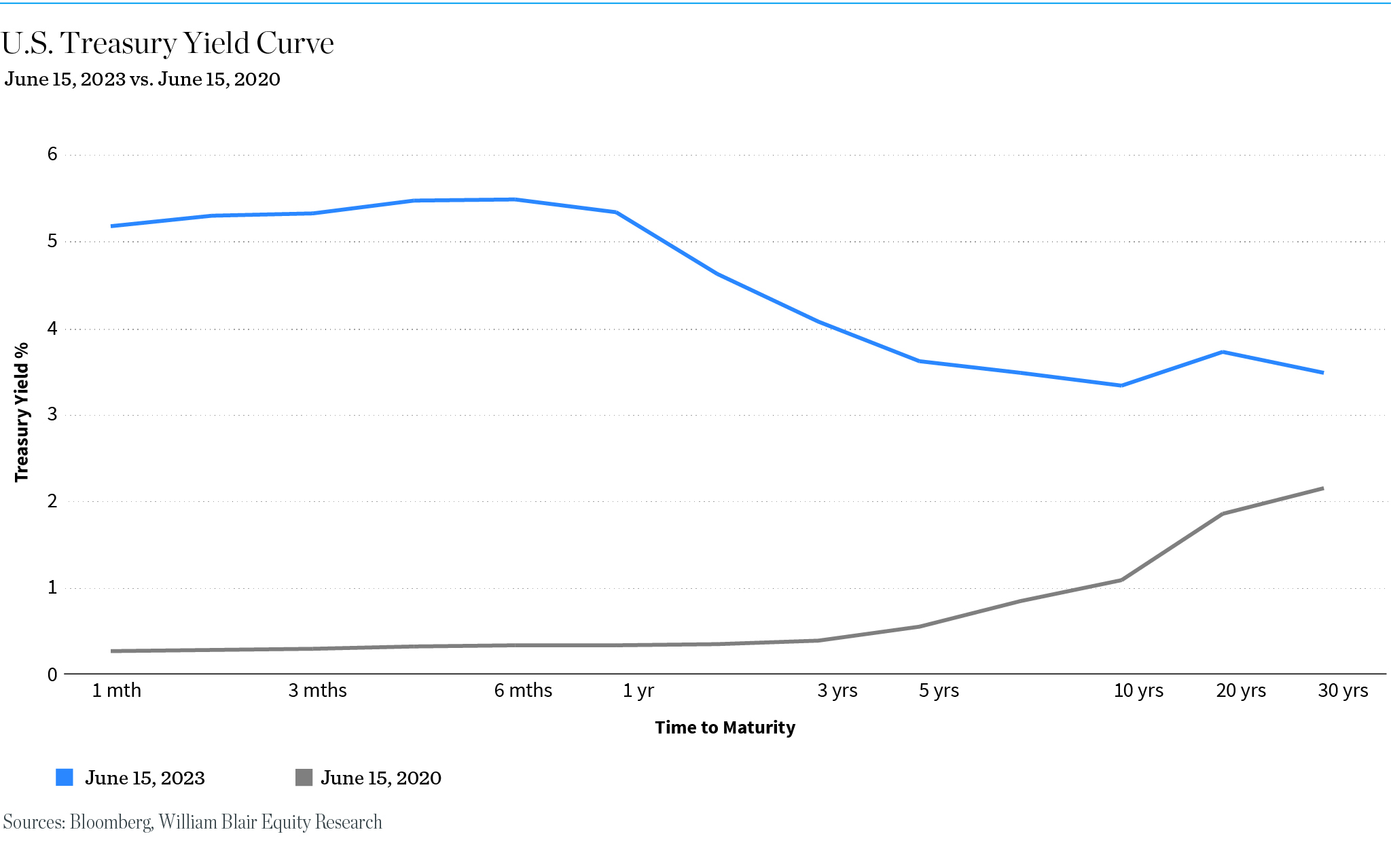

While yields have risen across maturities, the Fed’s move has created an inverted yield curve, with rates on short-term securities outpacing longer-term ones. In a more rational backdrop, the market would be paying investors more to take on longer-term bonds, since the longer an investment’s time to maturity, the more risk investors are assuming.

Longer-Term vs. Shorter-Term Bonds

The higher yields in the short end of the curve are certainly attracting a lot of investor interest, says Clancy Burson, a fixed-income trader at William Blair. And with long-term rates historically high, investors are now evaluating the trade-offs of holding longer-term bonds versus shorter-term.

For instance, in early June six-month T-bills were yielding 5% to 5.5% while 5- and 10-year Treasuries were close to 4%. But in six months, investors holding T-bills will face reinvestment risk.

“Given the Fed’s current policy, six to 12 months or more of relatively higher short-term interest rates are possible, but you’re going to have reinvest,” Burson says. “So looking out two or three years, owning a 5- or 10-year Treasury at 4% actually might turn out be the better investment.”

It comes down to measuring interest rate risk, Burson adds, looking at the relationship between the price and yield of a bond, or its duration.

“Right now from an asset allocation standpoint, we feel comfortable with adding duration exposure and extending maturities to lock in rates that we think will be attractive over time.”

The municipal bond market is seeing similar trends.

A major inflow of bonds into the marketplace over the last three months—from mutual fund managers liquidating short-term munis to meet security repayments, their outflows, and FDIC liquidations generated by the recent bank defaults—is keeping yields higher on the short end of the curve, says Debra Schalk, a William Blair fixed-income trader. While fund outflows have slowed recently, that has been offset by the largest number of municipal bonds on a monthly basis maturing in June. As a result, demand for bonds is strong, but so far yields have remained above 3% for 1-year bonds.

“Short-term municipals are providing an outstanding yield from an historical perspective with very little risk,” Schalk adds. “But 10-year bonds yielding over 2.5% is historically a pretty good yield too. Even though the short end is compelling at over 3%, it is also important to look long term and build a portfolio with various maturities, essentially laddering the maturities to maintain cash flows.”

Investment-Grade vs. High-Yield Corporates?

Investors wanting to take on a little extra risk are looking at the corporate bond market. It, too, is experiencing some unusual price relationships.

Those investors track the yield difference, or spread differential, between investment-grade corporate bonds, for example those rated A and BBB, with high-yield bonds, often referred to as “junk” bonds, which have lower credit ratings. Both factor in the yield on Treasuries—typically seen as the safest investments—plus the credit worthiness of the company issuing the bonds.

“In early June, for example, we were seeing a lot of good A and BBB corporates yielding over 5%, essentially going up pretty dramatically alongside the Treasury market,” Burson says. “So the credit spread hadn’t changed much.”

High-yield bonds, on the other hand, were yielding a little over 6%, a spread of about 1.25% when typically investors would be looking for a 2% to 3% premium to A or BBB corporates, given the added risk of holding junk bonds.

“Right now, high-yields bonds are not giving you that extra advantage while high-quality investment-grade corporate bonds are more attractive right now,” Burson says. “We will be watching to see if the spread widens out, then re-evaluate.”

Fed Watch

Analysts cite the Fed’s monetary policy and economic conditions as big drivers of the bond market going forward. At its June meeting, the Federal Reserve kept interest rates unchanged for the first time in more than a year. However, it signaled in its economic projections that rates could rise by another half of a percentage point before the end of the year.

The market expectation is that at some point soon, possibly by early 2024, inflation will reach a level where the Fed is comfortable halting its rate hike policy. Those holding bonds could be poised to benefit from that policy change. Bonds can also help in providing income and managing risk through a potential recession.

“Certainly, these are things to be aware of and keep a pulse on,” Glover says, “but the reality is we cannot control Fed decisions, the economy, or how the market is going to react. It’s not about timing the market, but rather focusing on a long-term strategy aligned with your investment goals.

“Ongoing communication with your William Blair advisor should remain a focus. That dialogue is valuable in this type of environment.”

Return and/or yield performance shown reflects past performance and does not offer any guarantee of future results. This information has been prepared for informational purposes and is not intended to provide, nor should it be relied on for, accounting, legal, tax, or investment advice. Please consult with your tax and/or legal advisor regarding your individual circumstances. Investment advice and recommendations can be provided only after careful consideration of an investor’s objectives, guidelines, and restrictions. The factual statements herein have been taken from sources we believe to be reliable, but such statements are made without any representation as to accuracy or completeness or otherwise. Opinions expressed are our own unless otherwise stated and are subject to change without notice.