In her blog, Before and After: How Ukraine Changed Our Outlook, Olga Bitel, global strategist with William Blair’s Investment Management team, shares her market insights and what she is watching going forward given today’s rapidly changing environment. The blog was first published on May 10. Bitel has nearly 20 years of experience analyzing macroeconomic and geopolitical developments to assess how global equity portfolios could be impacted. She has a B.A. in economics from the University of Chicago and an M.Sc. in economics from the London School of Economics and Political Science.

We survived the pandemic and are working through its effects on domestic inflation and global supply chains. We have adjusted to interest rates rising back to the average of the last decade. But just when we thought the world economy was regaining its footing, a military conflict in Europe has led us to reconsider our outlook for growth and inflation.

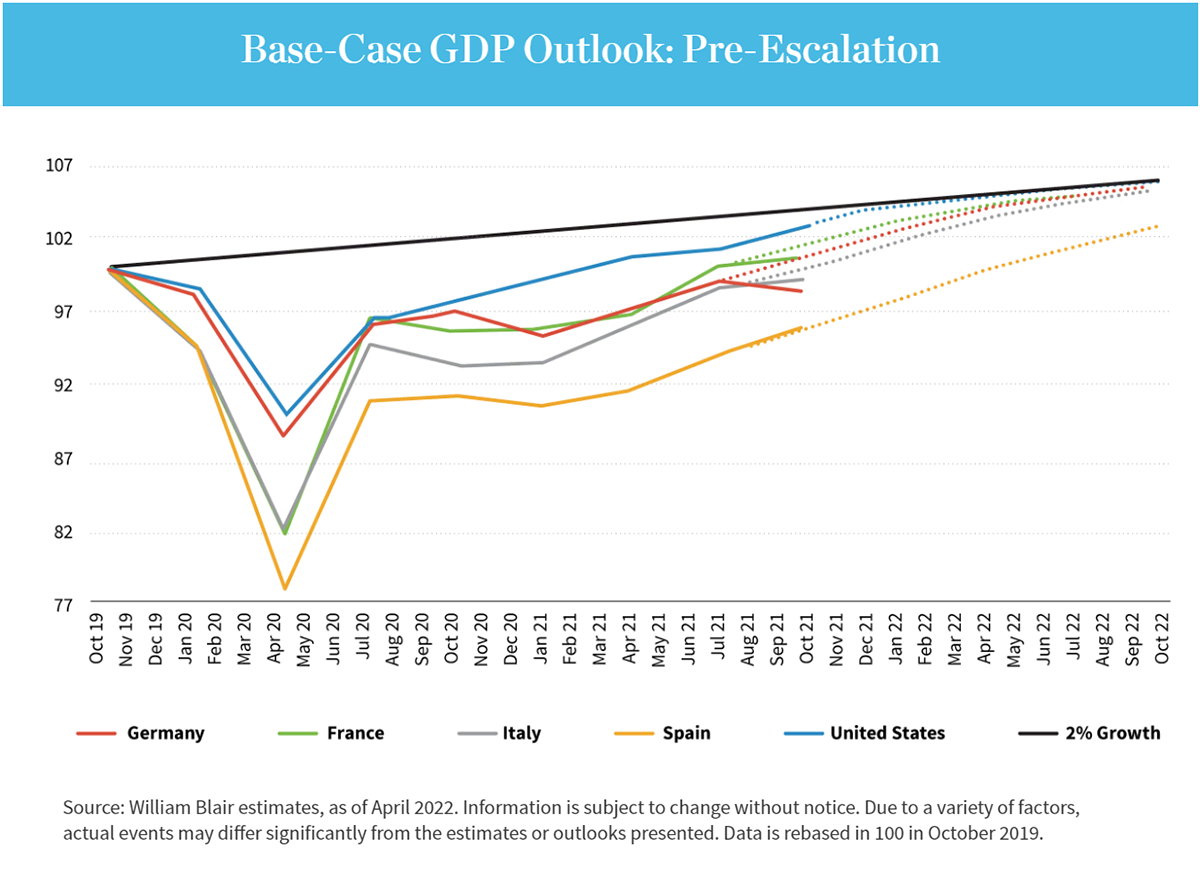

Pre-Escalation―Developed Markets Base Case

Most developed-market economies enjoyed a sharp V-shaped recovery post-COVID. The U.S. economy, in particular, was so strong that by the end of 2021 it nearly reached its pre-COVID output trajectory, shown as a hypothetical 2% growth line in the chart below.

Source: William Blair estimates, as of April 2022. Information is subject to change without notice. Due to a variety of factors, actual events may differ significantly from the estimates or outlooks presented. Data is rebased in 100 in October 2019.

U.S. gross domestic product (GDP) growth—and by extension corporate earnings growth—peaked at 12% year-over-year in the summer of 2021. Long before the Russia-Ukraine conflict, we expected U.S. economic growth to decelerate to a sustainable pace of 2% to 2.5% by the end of this year. In other words, we expected U.S. economic growth to slow down dramatically over the course of 2022.

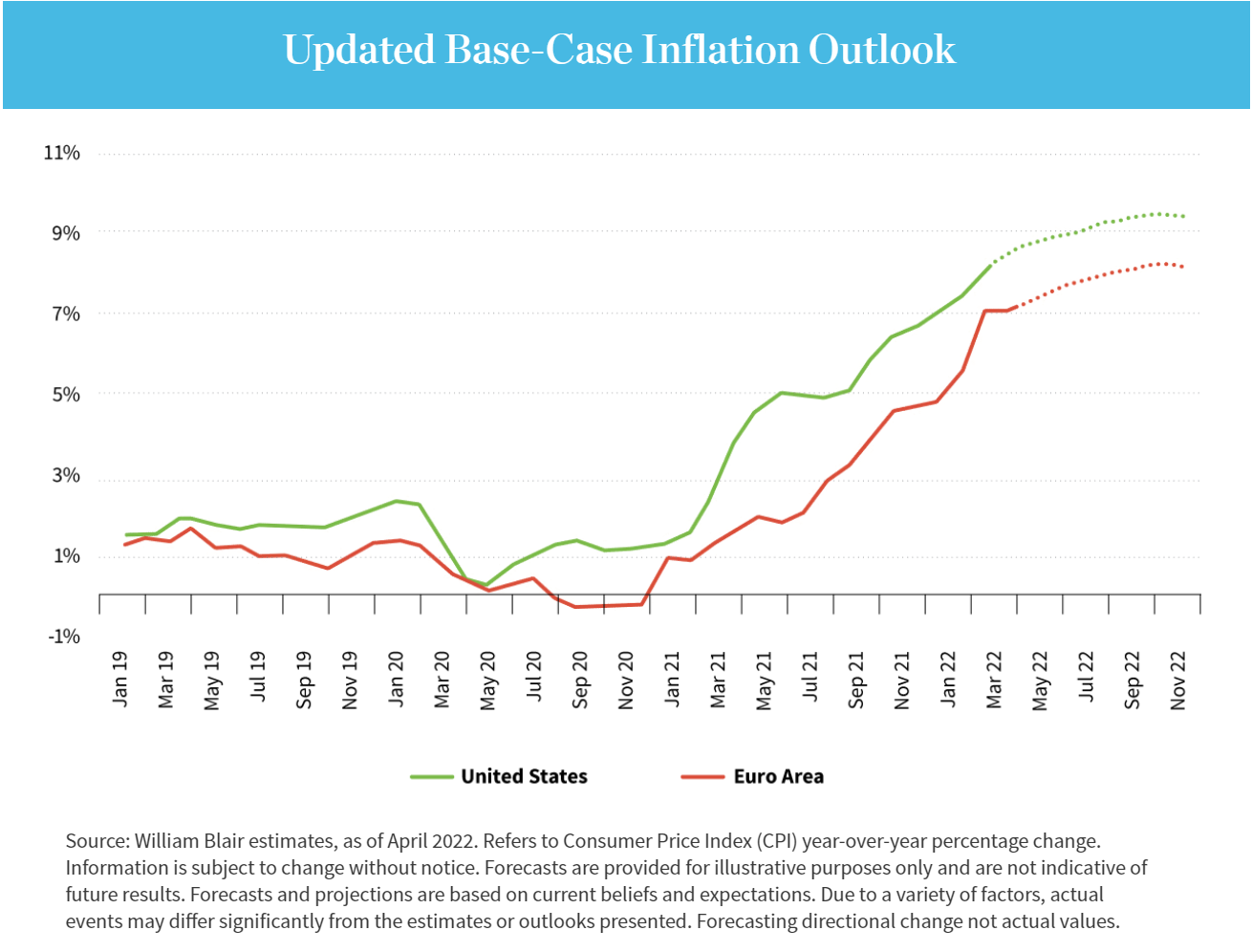

Consistent with sequentially decelerating economic growth, we believed U.S. inflation was likely to peak this summer and decelerate meaningfully thereafter to a plateau around 3% by the end of 2023. However, we were monitoring wage pressures because they remain a key variable to our U.S. inflation outlook.

A slowing economy and peaking inflation suggested that the corporate earnings growth would decelerate to about a 20% annual pace, which we consider consistent with a healthy 2.5% economic rate of economic expansion.

Putting it all together, we expected that growth in the corporate sector had already rolled over to what we regard as a sustainable rate. We thus expected the aggressive de-rating that began in the second half of 2021 and peaked in January and February 2022 to largely end by the second quarter of 2022.

Then Russia invaded Ukraine.

Reconsidering Post-Invasion

In light of Russia’s invasion, we developed a framework for thinking about the economic impact of the conflict on the economies outside the direct conflict. Specifically, we assess the impact at the intersection of the two vectors: perceived duration of the conflict and severity of sanctions. The chart below illustrates.

On the horizontal axis we approximate the perceived duration of the sanctions, as a supply response is less likely if market participants perceive sanctions to be of short duration.

On the vertical axis we estimate the severity of sanctions based on their disruptive impact on the global supply chains. For now, we assess the current set of sanctions as moderate, meaning that most principal industrial and agricultural commodity exports from Russia are still allowed to flow into the international markets.

We have already seen insurers and logistics operators shy away from Russian cargo, which has led to more price volatility in the commodities markets. U.S. oil and gas producers are responding to higher energy prices by increasing production.

Chart showing Severity of Sanctions (Impact on Global Supply Chains) vs. Perceived Duration

What does all this mean for our growth outlook? In a major change from our pre-escalation scenario, we now expect European economic growth to be materially lower in 2022, with major European economies unlikely to reach their pre-COVID GDP trajectory this year. We expect the U.S. economy to be largely unaffected, at least in the near term.

Regarding inflation, ongoing lockdowns in China and the military conflict in Europe have prompted us to revise our inflation projections. We now expect U.S. inflation to peak later in the year, sometime in early fall, and to roll over thereafter, more gradually.

Source: William Blair estimates, as of April 2022. Refers to Consumer Price Index (CPI) year-over-year percentage change. Information is subject to change without notice. Forecasts are provided for illustrative purposes only and are not indicative of future results. Forecasts and projections are based on current beliefs and expectations. Due to a variety of factors, actual events may differ significantly from the estimates or outlooks presented. Forecasting directional change not actual values.

Applying our revised growth and inflation expectations to corporate earnings and multiples suggests that there is further downside pressure to earnings growth, meaning there will likely be further headwinds to multiples. We expect multiples to stop de-rating when growth stabilizes.

Looking at emerging markets, we tend to see sustained outperformance in emerging markets equities when three conditions are met: global growth accelerates; the growth differential between emerging and developed markets widens (meaning that emerging markets are growing faster than developed markets); and U.S. interest rates are stable or declining.

Most of these conditions are not in place today. We may see a wider growth differential between emerging and developed markets in the months ahead, but even that condition is somewhat suspect. This is very much a high-level conclusion, and emerging markets are quite heterogeneous, offering varying opportunities and risks.

Rethinking Energy Dependence

The conflict in Ukraine—regardless of the outcome—is likely to materially increase our attempts to find greener or more sustainable energy sources and accelerate our development of more efficient and environmentally friendly transport.

This is similar to what transpired in the early 1970s, when a number of small European countries took oil transition to heart and became energy exporters within a decade and a half. Denmark is a good example.

It will be tricky, because the energy transition is commodity-intensive. Batteries for electric vehicles and semiconductors for next-generation computing require ever more commodities—not just lithium and nickel, but also copper. Many such inputs come from jurisdictions with different governance structures and social norms.

Moving away from fossil fuels entails geopolitical ramifications. Under the auspices of the United Nations and the Group of Twenty, we may need to rethink how we engage with jurisdictions where the governance structures might be quite different from ours. We must figure out, collectively, how to engage with these countries, involving them in the global economy so conflicts like the one we’re seeing now are less viable and thus rarer.