Now that we are halfway through the year, economic signals offer a mixed reading of what’s ahead for the U.S. economy. Inflation is cooling but remains twice as high as the Federal Reserve’s target. Employment remains historically high, consumers continue buying, and the most forecasted recession in history has yet to arrive.

Richard de Chazal, a macro analyst with William Blair's Equity Research team, shares his insights with Client Focus on these topics and the economic factors he’s watching to gauge growth as we head into the last six months of 2023.

- Client Focus: Given the variety of mixed economic signals today, which factors are you watching most closely to gauge growth or a recession?

- de Chazal: Given that the U.S. consumer accounts for 70% of aggregate GDP, there is an old saying: “where the consumer goes, so goes the economy.” At the moment, the U.S. consumer continues to hang in there.

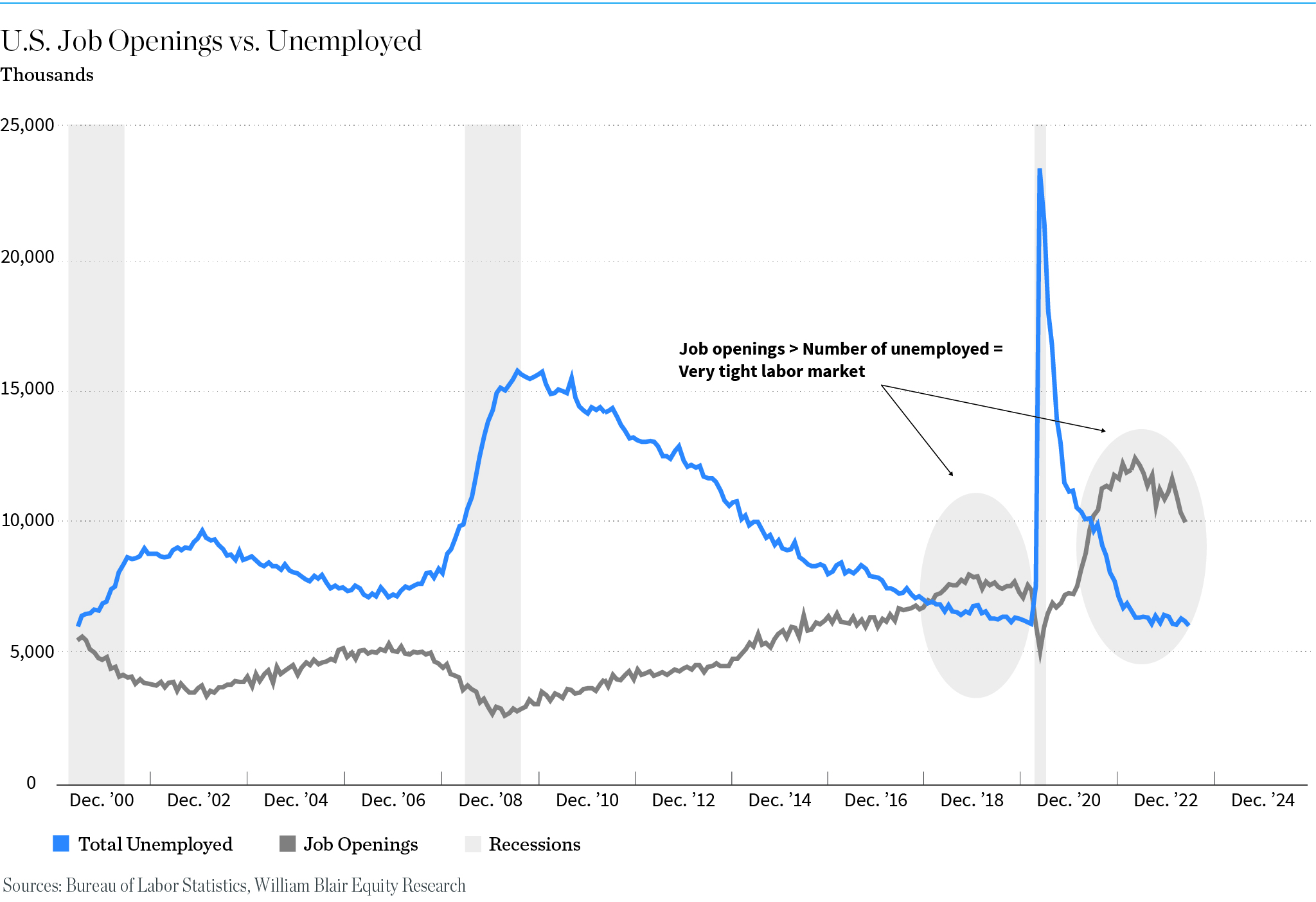

With the unemployment rate the lowest it’s been in more than half a century (9.6 million advertised job openings vs. 5.9 million available supply of workers), mortgages that are locked in at much closer to 3% than 7%, solid balance sheets that are still holding some residual excess savings from the great COVID giveaway, is it any wonder consumer confidence is still above the historical average? And the so-called “most forecasted recession in history” still doesn’t seem to have arrived.

Nevertheless, with the Federal Reserve and other major central banks having embarked on what has been the fastest tightening cycle since at least 1970, we are definitely starting to see some cracks emerging.

The first port of call has been the financial markets, where the bulk of the adjustments in both the equity and bond markets was likely carried out last year. We also continue to see the Treasury market yield curve deeply inverted, a gauge that almost always precedes a recession.

The impact from the rate increases moved along to the most interest-rate-sensitive sectors of the economy—including housing and large durable goods (however, autos are seeing less of an impact as there is still some post-COVID catch-up taking place). Housing starts, for example, are now 22.3% lower than a year ago.

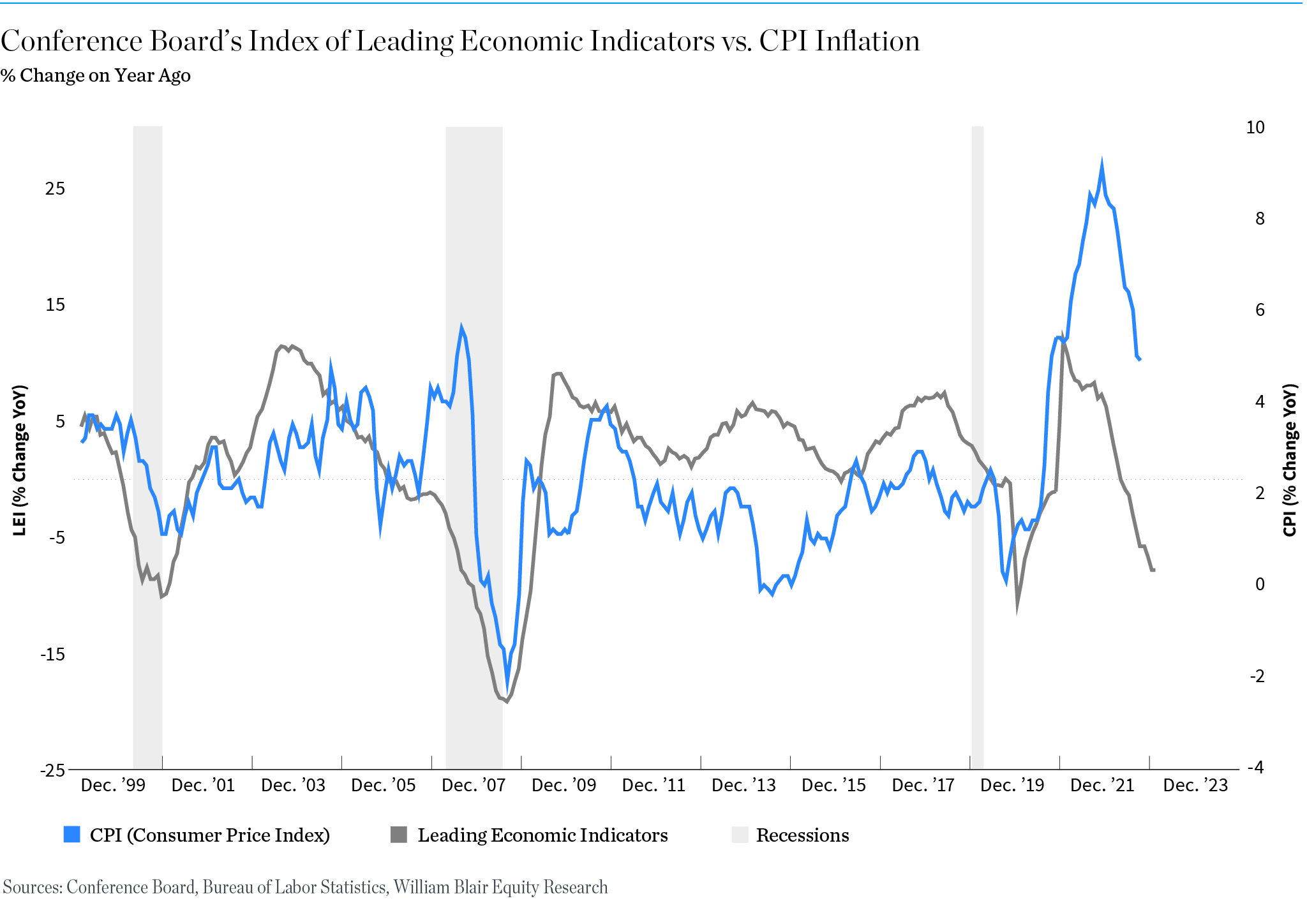

Meanwhile, basket indices of the economy’s historically leading economic indicators, such as those released by the Conference Board (including initial jobless claims, capital goods orders, yields spreads, the money supply, the stock market, and consumer confidence), are also now deeply negative.

Finally, higher rates are starting to squeeze parts of the banking system, in particular smaller regional banks that may be more exposed by their lower deposit rates and holdings of commercial real estate. We are now keeping a very close eye on the coincident economic indicators, such as retail sales, industrial production, and employment, for clues as to the extent to which the impact of higher rates is moving deeper into the real economy.

It is worth noting that the financial markets reacted positively to U.S. lawmakers’ decision to raise the debt ceiling, thus avoiding the negative impact a debt default could have had on economic growth and investor confidence. However, since the debt ceiling was reached in January, the Treasury was prevented from issuing any new debt since then. As a result, the Treasury will have to ramp up debt issuance in the coming months to refill its coffers and meet the spending obligations that have already been obligated by Congress via the federal budget. All things being equal, this may put further upward pressure on Treasury yields.

- Client Focus: Based on those signals, what is your current economic outlook for the remainder of 2023?

- de Chazal: Given what we see happening to the economy’s leading economic indicators, it looks as though a recession will be very hard to avoid. Rather, it seems to be a question of how deep and how long?

The answer will largely depend on what happens to inflation. We currently expect it to fall to around 3.5% later this year and then lower in 2024. If it continues to prove stickier than expected, the onus will be on the Fed to do more to achieve its target of 2%. While some currently think if that happens the Fed could just increase its inflation target to 4%-5%, we do not see this as a realistic possibility. Raising its inflation target would simply be seen as moving the goal posts, and further deeply damage its already bruised credibility.

We continue to believe that the economy is on track for a more mild recession. What typically turns a “normal” recession into a major financial crisis is leverage and forced deleveraging. We do not see extreme amounts of leverage at the moment in the consumer or financial sectors.

While we believe that problems are likely to persist in the banking and commercial real estate sectors, causing some further disruption and volatility, the quality of the assets the banks are holding and the loans they have been making is considerably higher than was the case in the lead-up to the Great Financial Crisis. Furthermore, the banks have not leveraged themselves 30- or 40-to-1 on the back of securitized dodgy subprime loans that were stamped AAA and used as collateral for more lending, which was the case with the financial crisis.

- Client Focus: What are the implications for investors, the markets?

- de Chazal: As the Fed’s rate increases continue to bite deeper into the real economy, investors should be prepared for some further volatility. There will likely be some tweaking of analysts’ earnings estimates over the coming year, and at some point bad economic news will also be viewed as bad economic news by market participants. This is in contrast to what’s happening at the moment, where bad news is still viewed as good news by investors, who are keen for the Fed to start lowering interest rates.

For longer-term investors, particularly those looking at high-quality growth stocks where pricing often comes at a premium, these periods of volatility can often represent significant points of entry. - Client Focus: As we head into the next six months of 2023 and beyond, what should long-term investors be focused on?

- de Chazal: While we are not particularly optimistic about the very near-term cyclical economic outcome, we know the Fed has to do its job and economic growth does not move in a perfectly straight line up and to the right. Where we think investors should be focusing at the moment are those areas where valuations are historically attractive, and which are similarly benefiting from structural growth drivers. For example, we see digitization, machine learning, robotics, and AI as transformative across a wide array of industries and sectors from the consumer to healthcare to manufacturing, and technology, to the point where we are arguably at the start of a major sustained capex boom.

Following COVID—when most companies suddenly woke up to the reality of underinvesting in capital equipment and technology for years—we think companies today are increasingly willing to embrace investment. Listening to the many companies who presented at our 43rd Annual Growth Stock Conference in June, many of them are being constrained by a structurally tighter labor market due to slower population growth and an aging labor force. Growing geopolitical headwinds, related to the desire to diversify away from China and the disruptions caused by Russia’s invasion of Ukraine, only add to that sentiment.

As a result, they are also telling us that they will increasingly be looking to automation and innovation to improve productivity and profit margins. And, they also have the fiscal incentive to do this following a number of fiscal packages initiated by the Biden administration, including the Inflation Reduction Act, the CHIPS Act, and the Infrastructure Investment Act.