The U.S. institutional leveraged loan market cooled in Q4 to close out a year characterized by lackluster deal flow, a persistent shift from syndicated markets to private capital, and high interest rates that took a toll on borrowers. With those themes fueling competition for high-quality credits—and with expectations that the Fed is done raising rates—lenders appear increasingly optimistic about 2024.

Highlights of this quarter’s William Blair Leveraged Finance Report include:

- Analysis of Q4 U.S. leveraged loan market performance

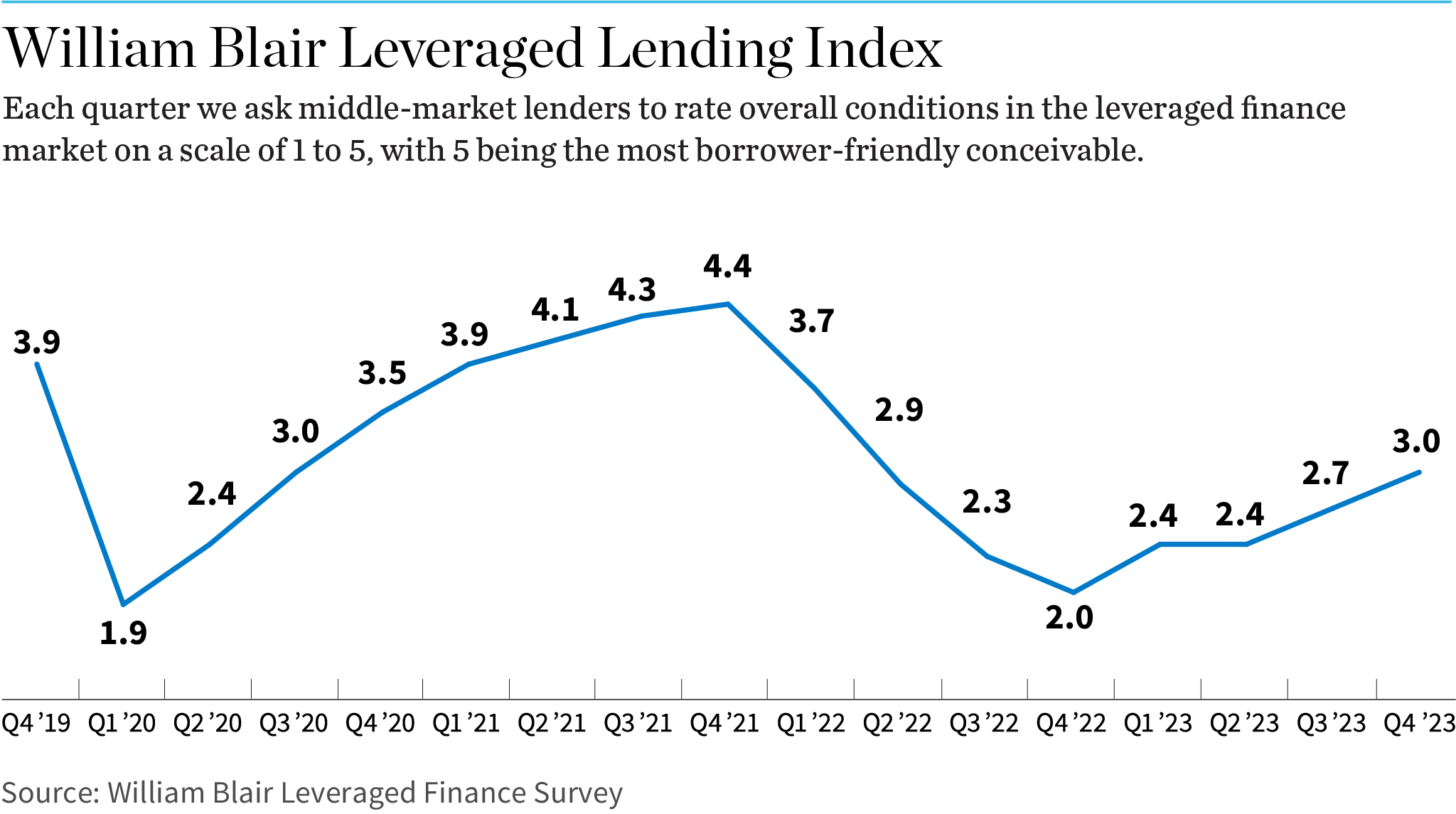

- Highlights, analysis, and results from the William Blair Q4 2023 Lender Survey