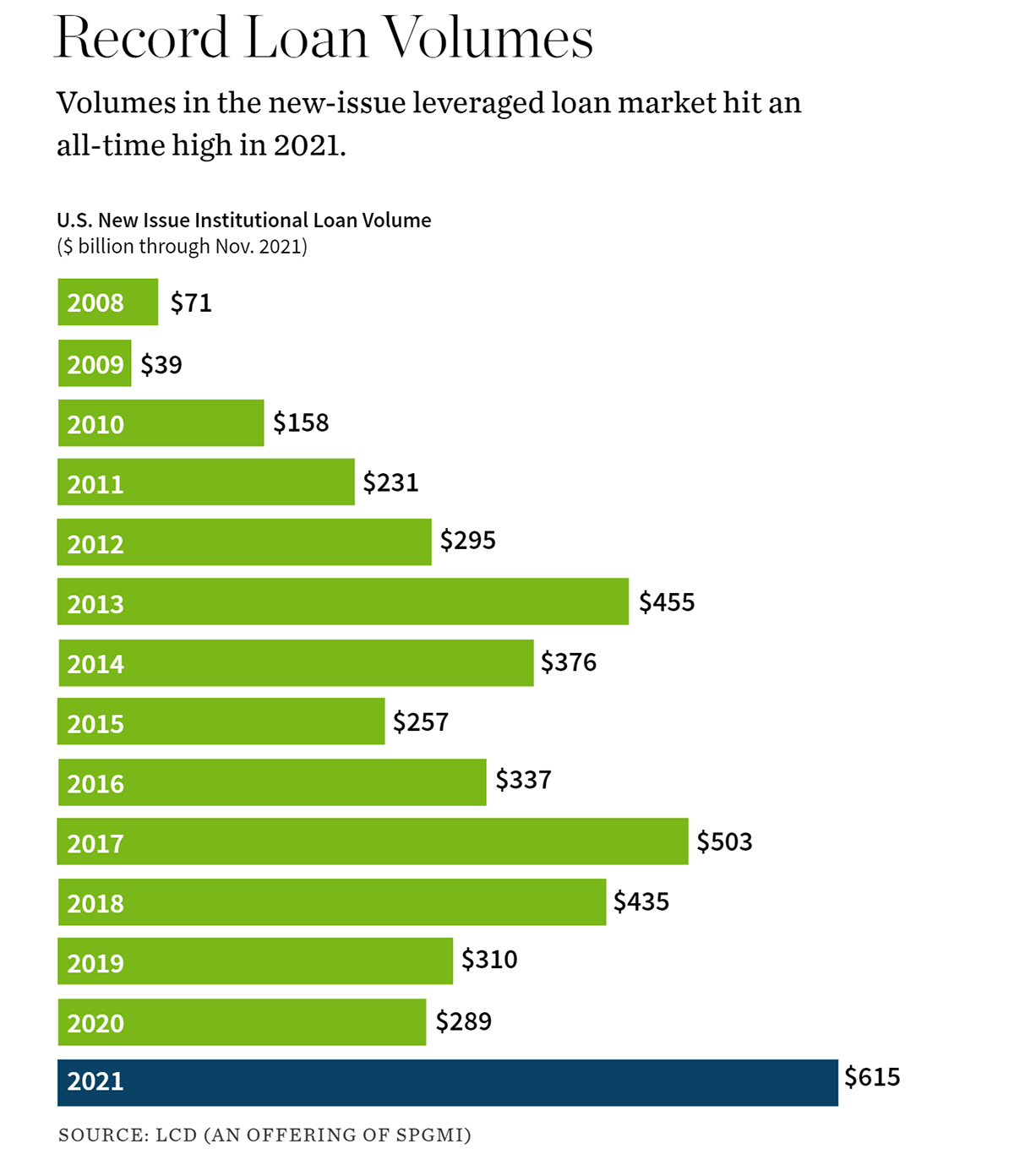

Debt financing markets continued to experience powerful momentum in 2021. Deal volume hit an all-time high, new financing options emerged, and private credit continued to increase its share among middle-market borrowers. These tailwinds have set the stage for a strong 2022.

In this year-end review, William Blair’s Leveraged Finance Group reviews the key themes that drove leveraged finance markets in 2021 and looks ahead at the trends that will shape the debt financing market in the coming year.

Key takeaways:

- New-issue volume in leveraged loans hit an all-time high in 2021, and more than half of new issuance consisted of debt raised to support M&A activity. The market also became more complex as new entrants and new products emerged, creating a rapidly changing leveraged loan landscape amid the influx of deal activity.

- Elevated competition among lenders has led to increasingly advantageous terms for borrowers. Top concessions from lenders included reduced interest rates and fees, increased leverage, and loosened terms on covenants or other documentation items.

- Recurring-revenue loans stepped out of the shadows in 2021, providing additional financing options for late-stage companies. The expansion of the ARR-based financing market was fueled by massive demand for investments in software businesses, an area that has shown resilience during the pandemic.

- While the competitive environment helped drive improved terms, borrowers also found it increasingly difficult to get lenders’ attention on financing opportunities in 2021 as a result of internal capacity constraints.

- Some of the key themes that we expect to define the leveraged finance market in 2022 include rising interest rates and inflation, the emergence of ESG issuance, the borrower-friendly market environment, and the potential for continued capacity constraints among lenders.