Left for dead for nearly two years, the M&A leveraged loan market came back to life in the third quarter, with the Fed’s first interest rate cut in years opening the door for a wave of activity. While total loan volume slowed, non-refinancing issuances reached their highest levels since 2022. Learn more about Q3 performance and trends shaping the leveraged finance market in our latest report.

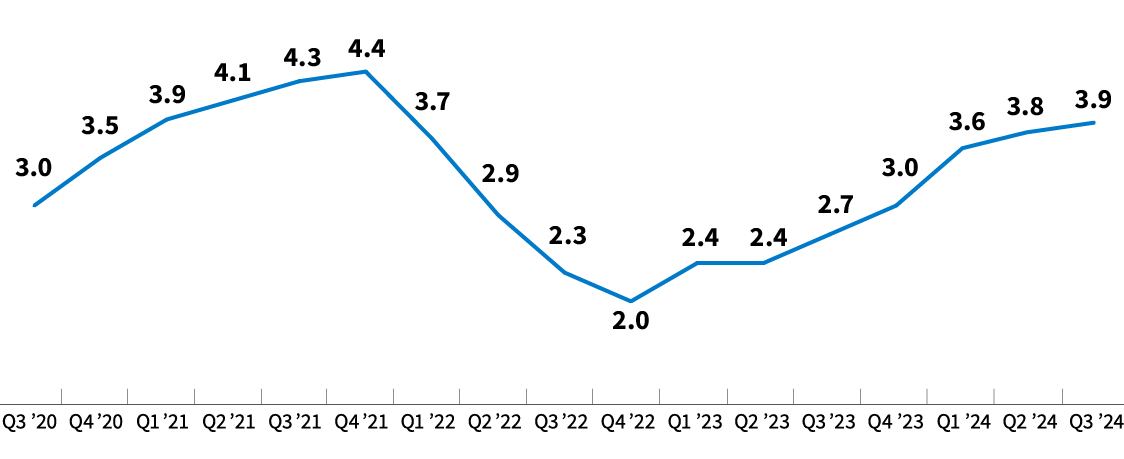

William Blair Leveraged Lending Index

Each quarter we ask middle-market lenders to rate overall conditions in the leveraged finance market on a scale of 1 to 5, with 5 being the most borrower-friendly conceivable.