Opportunistic activity soared in the fourth quarter as borrowers capitalized on tightening spreads, closing out a record-setting year driven by the combination of rate cuts, a more stabilized economic outlook, and robust investor demand.

While opportunistic activity stole the show last year, investors are hopeful that a yellow brick road will lead the way for M&A opportunities to reclaim the spotlight in 2025.

Learn more about Q4 performance and trends shaping the leveraged finance market in our latest report.

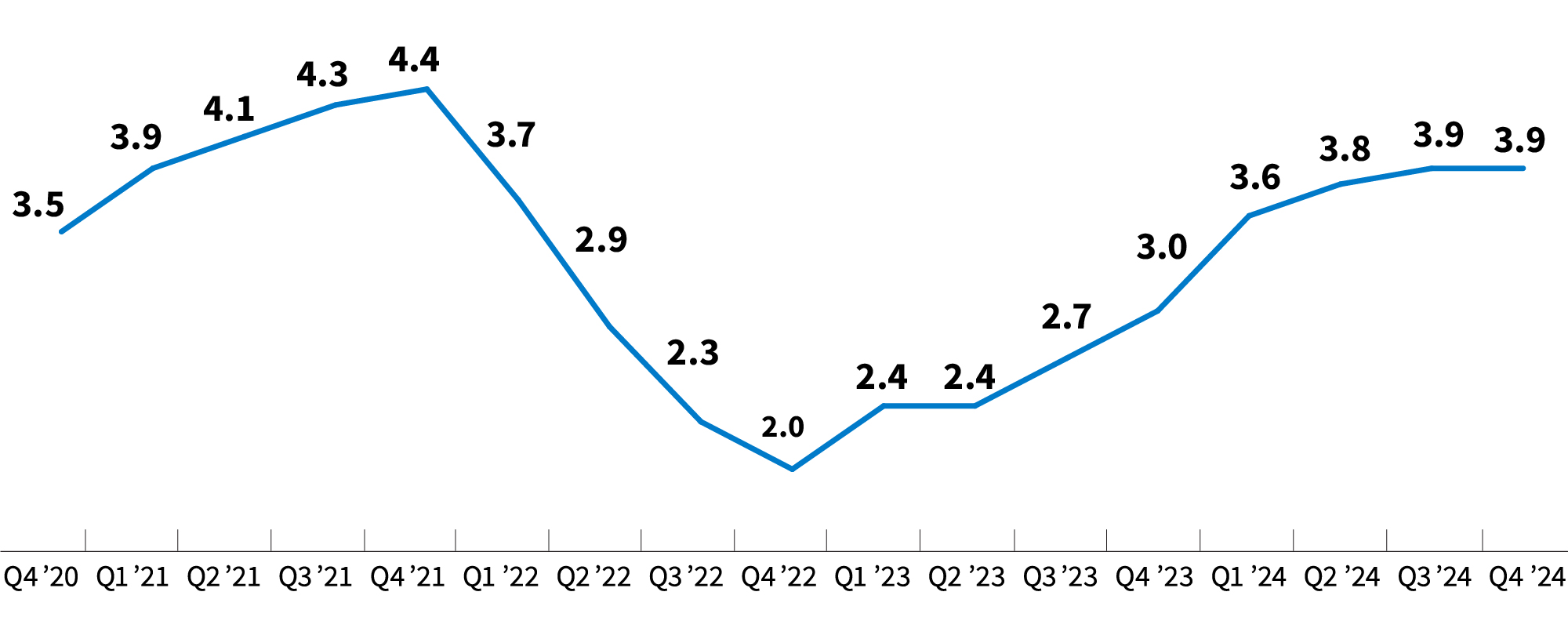

William Blair Leveraged Lending Index

Each quarter we ask middle-market lenders to rate overall conditions in the leveraged finance market on a scale of 1 to 5, with 5 being the most borrower-friendly conceivable.