After unprecedented changes in 2020 driven by the coronavirus pandemic, hopes are high for economic growth in 2021 as society reopens. William Blair's London-based macroeconomist Richard de Chazal, CFA, who has more than two decades of experience analyzing the U.S. economy and financial markets, shares his outlook for 2021.

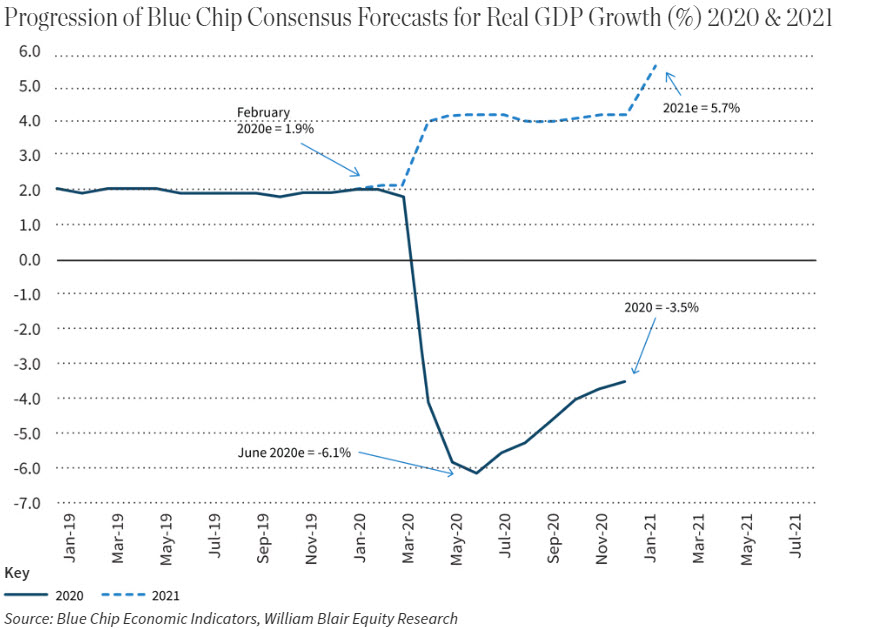

The arrival of several COVID-19 vaccines, President Biden’s economic plan, and hopes for consumer spending to return to more normal levels raise the prospect for strong economic expansion in 2021. Following last year’s dismal -3.5% in U.S. GDP, many analysts are forecasting 5.7% growth this year. However, we think it is very possible that growth could come in north of 6.0%.

This optimism has helped fuel the equity markets in early 2021.

The overwhelming caveat for recovery is predicated on containing the virus and continuing the vaccine rollout. Given the speed in which the vaccines were developed, there have been questions. For example, will the vaccines remain as effective as initial tests suggest? Will virus mutations evolve to a point where the current vaccines are less effective? How soon will we reach herd immunity? And how long will social restrictions stay in place?

Even though there is plenty of uncertainty around these questions, the prospects for the vaccines to be successful looks extremely good. Currently, we are seeing a dramatic decline in the number of COVID deaths and hospitalizations. In addition, as more of the population receives the vaccine, we move closer to reaching the much-longed-for herd immunity.

What factors will drive expansion?

Personal consumption. U.S. savings hit a record high over the last year as the coronavirus caused Americans to limit spending and stockpile cash. Meanwhile, another round of stimulus by the new Biden administration will add to this. As economies open up and life returns to some semblance of normality, consumers will be keen to get out, socialize, and spend.

Business investment. The COVID pandemic exposed just how underinvested many companies had been in numerous areas of technology. As a result, there was a rush to upgrade systems to adapt to the sudden changes of working in a more digital world. Many businesses still face serious investment shortfalls, which will continue to drive technology spending in the coming year.

In addition, companies are desperately short on inventory, as they were not prepared for the jump in demand for consumer durable goods (e.g., cars, electronics, home appliances, furniture, medical equipment) in the second half of 2020. Furthermore, closed borders and COVID-related restrictions have made it increasingly difficult to obtain needed supplies to meet that demand. One of the most prominent among these has been semiconductors.

Exceptionally low interest rates and high cash balances should help to sustain this investment.

Government support. Now that Biden’s $1.9 trillion stimulus package was passed by Congress, it appears the focus will quickly turn to green infrastructure spending.

International growth. As COVID-19 spread from one country to the next last year, economies worldwide all tipped into recession at roughly the same time, i.e., within the space of about six months. Now, we are starting to see a more synchronized recovery, following vaccine rollouts and the implementation of strong global fiscal and monetary support. Meanwhile, in contrast to the 2008-2009 Global Financial Crisis, policymakers are not eager to remove this stimulus and impose austerity as the recovery gains traction. In short, synchronized global growth will be a powerful tailwind.

Inflation moderately higher

Robust economic recovery, large government spending, and an extremely loose monetary policy combined raises the risk for a surge in inflation. Yet, we believe the expected near-term spike in prices will not be sustained, with prices only moderately higher.

In spring 2020, the consumer price index (CPI)—a measure of inflation—fell sharply, and by May, it declined 0.1% annually and crude oil prices turned negative. As the pandemic recedes and life returns to normal, prices should be comparatively higher. That alone will help push the inflation numbers above the Fed’s 2% inflation target. However, as 2021 progresses this initial pickup in inflation will likely wane.

Furthermore, as Federal Reserve Chairman Powell recently noted, the unemployment rate is still elevated, and it will take time to return to full employment. Fortunately, many companies only temporarily mothballed production, and did not shutter it completely. Hence, there is plenty of capacity in the economy, which will help to keep a lid on inflation.

Financial market activity

With the Federal Reserve keeping its benchmark overnight interest rate near zero, the continuation of its massive bond-buying program, and robust economic growth, we expect upward pressure on longer-term interest rates, i.e., a steepening of the yield curve. This could mean that 10-year T-Note yields, now hovering around 1.6%, reach 1.8% in the coming months. As long as these increases are driven by economic growth, and not purely by rising inflationary expectations, this should be a healthy and desirable outcome for equity markets. It also suggests that the economy is progressing toward normalcy.

In 2020, the growth in the equity market was entirely driven by multiple expansion, where a stock’s price/earnings (PE) ratio increases due to expectations rather than underlying earnings growth. This caused considerable angst among the public—the stock market rising while the economy was doing so poorly. In reality, the market was responding to the swift and powerful responses from the global monetary and fiscal authorities, all while anticipating the strong economic recovery in 2021.

We expect this optimism to be justified with a very solid rebound in earnings, driven by robust spending growth, cost cutting and investment made in 2020, a weak dollar, moderate pricing power, and productivity gains.