The Russia-Ukraine war is increasing nations’ attempts to find more green energy sources and accelerate the development of cleaner alternatives to fossil fuels. Alaina Anderson, CFA, an international portfolio manager with William Blair Investment Management and nearly two decades of experience analyzing global energy markets, weighs in on how this could play out and what it means to the renewable energy sector.

Russia’s invasion of Ukraine and the ensuing energy crisis across Europe have underscored how energy security, national security, and climate interests have become entangled. Undoubtedly, one of the most critical challenges facing European countries is cutting their dependence on Russian energy while accelerating their initiatives to boost renewable energy production.

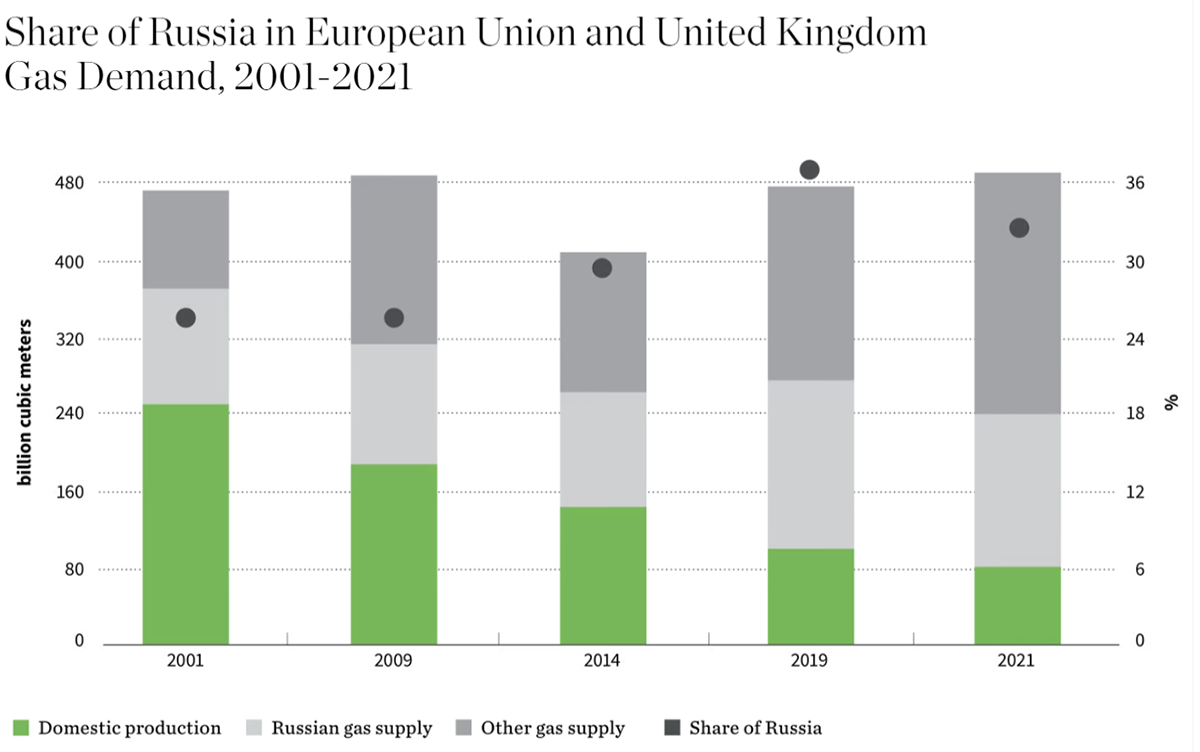

Russia, a global supplier of oil and gas, is among the top three producers of crude oil and a giant in natural gas markets, supplying nearly 40% of the EU’s natural gas. As the Russia-Ukraine crisis has escalated, Russia has made steep cuts in delivering natural gas to Europe via the Nord Stream—its biggest pipeline to Europe whose majority shareholder is the Russian state-owned company Gazprom.

Every day that the Nord Stream pipeline doesn’t run as expected deepens an energy standoff between Russia and the EU, sending inflation higher and raising the risk of gas rationing and recession. This is a dynamic, fluid situation, creating much uncertainty not only around European power prices and the ability of industries and consumers to secure power but global economies as well.

The severity of the situation was underscored by the European Commission in mid-September when it unveiled several proposals to cut electricity demand, cap revenues of utilities and fossil fuel companies, and make changes to how EU’s gas and electricity markets function.

How does a country become less reliant on energy imports? It’s by generating power domestically. Renewable sources of energy are a great way to ensure the domestic generation of power.

But that doesn’t happen overnight. It can take years for renewable projects such as solar and wind farms to come to fruition due to lengthy planning and permission processes imposed by governing authorities. In some cases, competitive auctions are conducted to determine which developers will be allowed to develop projects and how much their assets will earn. European auctions are now scheduled through 2022 and are already planned into the first half of 2023.

Rethinking Energy Dependence

To meet Europe’s immediate energy needs, it has increased imports of U.S. liquid natural gas (LNG), a substitute for natural gas. Even though the United States supplied more LNG to Europe during the first six months of 2022 than it did during all of 2021, limited terminal gas capacity across Europe to receive, store, and re-gas supplies (i.e., change the liquid back into gas) constrains LNG as a viable substitution. So, coal is being marshalled to fill the gap in natural gas flows.

Germany, Europe’s largest economy, instituted an emergency gas plan this summer that called for bringing idled coal-fired plants back online while declaring it would accelerate the “expansion of renewable energies in an unprecedented way.”

The European Union in May ratified REPowerEU, a huge policy initiative to invest $210 billion euros between now and 2027, to accelerate its clean energy transition and increase Europe’s energy independence from Russian fossil fuels. In mid-September, when the EU released proposals to mitigate high energy bills, it repeated its commitment to the REPowerEU plan “with the aim to end the Union’s dependence on Russia fossil fuels as soon as possible, and at the latest by 2027.”

REPowerEU is an exciting program and definitely supports the growth of renewable technologies across Europe, including:

- Asolar strategy to double solar photovoltaic capacity by 2025;

- A biomethane action plan that includes producing higher levels of domestic biomethane and renewable hydrogen;

- Doubling the rate of deployment of heat pumps; and

- A solar rooftop initiative to install solar panels on new public, commercial, and residential buildings.

We are seeing a parallel movement in the United States with the Inflation Reduction Act. The act earmarks $369 billion for clean energy and climate change provisions with billions of dollars going toward incentives to expand the use of solar panels, wind turbines, batteries, and geothermal plants. There are tax credits of the same magnitude for the manufacturing, transportation, and agriculture industries to decarbonize. It also includes $27 billion allocated for green banks to support financing of energy projects in disadvantaged communities.

Certainly, there are differences between the two. The Inflation Reduction Act is a law designed to further drive domestic expansion of the renewable industry. REPowerEU is set of renewable energy guidelines for the EU countries to adopt. Either way, governments can incentivize meaningful pools of capital to accelerate the development of renewables. There are also other important sources of capital such as sovereign wealth, private equity, and banks.

We just have to be cognizant that today’s capital commitments will not alleviate Europe’s immediate energy crisis. The disruptions caused by war coupled with lingering COVID supply-chain issues, inflation, and the acceleration of climate change add to the fragility of today’s energy system. European power prices are likely to stay elevated for the next couple of years.

However, we remain positive about the intermediate- and long-term outlook for renewables.

The Future is Green

Now is the time for change. In many ways it is similar to what Europe faced in the 1970s when the OPEC oil embargo choked off oil supplies, driving petroleum prices sky-high. Several European countries embraced change and became energy exporters within a decade.

Going forward, the transition to green energy must be thoughtful and measured. We have to be more creative and less exclusionary in finding climate-friendly solutions. There will be more conversations about nontraditional sources for energy such as green hydrogen. And nuclear energy also will be on the table as a solution to the energy crisis.

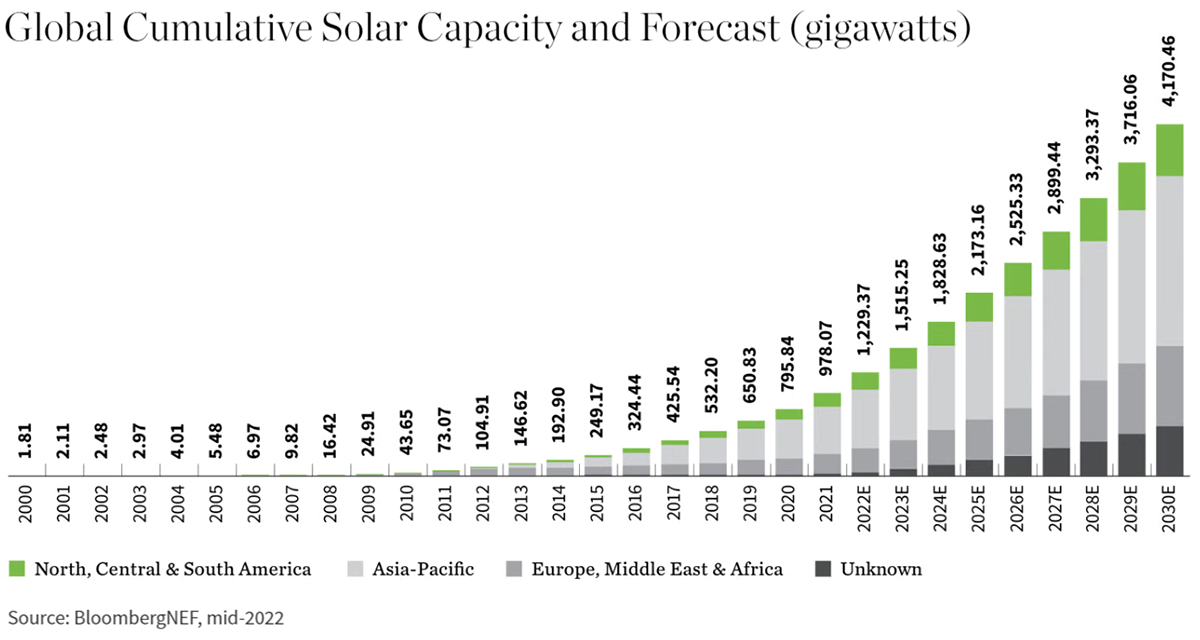

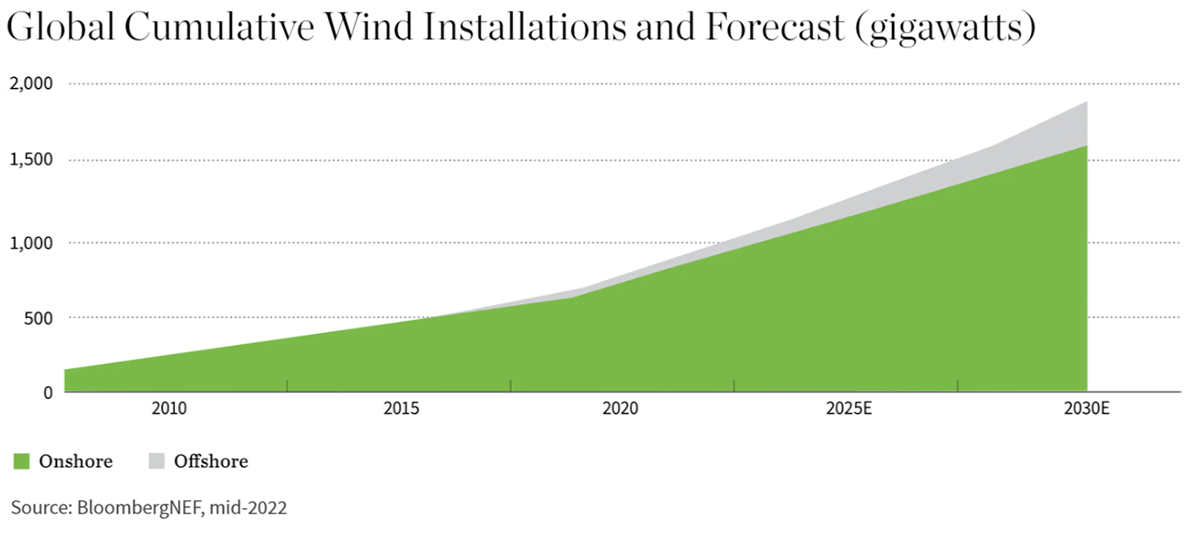

Already, there are a number of European wind and solar projects set to come online in 2022/23 that should add 45 gigawatts of solar and 23 gigawatts of wind capacity. That represents 20% expected growth in solar and nearly 10% growth in wind installed capacity from 2021/22. REPowerEU offers material initiatives for the EU to phase out its dependence on Russian oil and gas despite the headwinds caused by the Russia-Ukraine crisis.

Europe is committed to growing its renewable energy industry. That only emphasizes our thinking that the future is green.