As we face stay-at-home measures to slow the spread of the coronavirus, it is a reminder of how much we rely on the internet as a social outlet and for entertainment. This has added to what already has been explosive demand of video streaming—sweeping through society in general and the entertainment industry in particular.

Moreover, the streaming giants are not just headed for dominance in delivery of must-see video. They are quickly dominating featured video production itself.

Just look at this year's film nominations. Streaming giant Netflix led all comers with 24 Oscar and 34 Golden Globe nominations, including two original films touted for Best Picture—The Irishman and Marriage Story. It was a similar story with television.

As Americans stay home because of COVID-19, streaming TV hours are up. For the first three weeks of March, the estimated minutes streamed was 400 billion, up 85% compared to March 2019, Nielsen reports on March 31.

The Motion Picture Academy of Arts said last year that worldwide subscriptions to streaming services (613 million) for the first time had surpassed traditional cable (556 million).

"It really began in earnest in the 2013 time frame when Netflix released new TV shows like House of Cards and Orange Is the New Black," says William Blair analyst Ralph Schackart, who specializes in the digital media and internet sector. "People were scratching their heads asking, 'how can a technology company take on Hollywood?' Now we know."We believe 2020 will again prove to be a strong year for over-the-top video environment.

Streaming services started challenging the status quo in video entertainment in 2007. That's when Netflix began streaming movies and television shows over the internet. Consumers no longer needed to go to the movies or rent DVDs to access film.

By 2013, driven by rising costs for licensing content and by a vision that its long-term growth would hinge on original content, Netflix released those first two television series "over-the-top"—i.e., via the internet and bypassing cable, broadcast, and satellite television. Both were blockbusters.

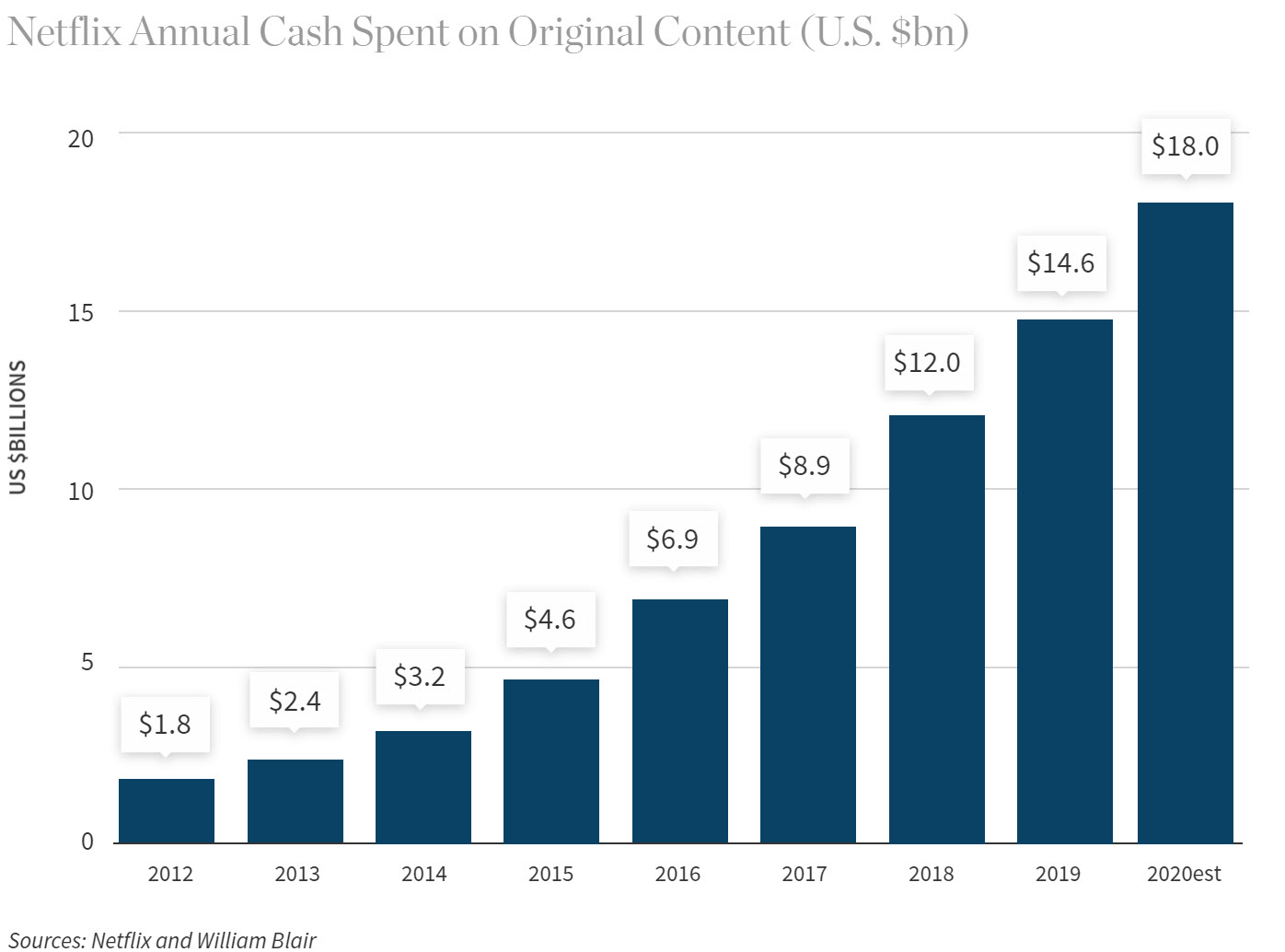

Today, Netflix leads the industry in original content, spending $15 billion in cash on content in 2019 alone. Last year Netflix released an amazing 195 new shows, more than its top 20 competitors combined, Schackart says. Its biggest content competitor is now another tech company: Amazon.

The "Amazon effect" is already being felt as the online giant creates its own growing stable of popular original television series, including The Crown, The Marvelous Mrs. Maisel, and Jack Ryan. Amazon in 2019 also expanded its international movie library. With its streaming largely free for Amazon Prime customers, its audience is vast.

Companies that are delivering content have to morph their businesses to align with the consumer.

"It's been the change in viewing habits and video consumption the last couple of years that finally convinced content creators this direct-to-consumer product is a good way to maximize viewership and advertising dollars," says William Blair analyst Jim Breen, who covers the internet infrastructure sector. "Companies that are delivering content have to morph their businesses to align with the consumer."

Media giants get onboard

Legacy media giants like NBCUniversal, Disney, and WarnerMedia—traditional masters of "content"—largely stayed on the sidelines, relying on cable providers to distribute their shows. But they are now playing catch-up, launching new video streaming services of their own content targeted to match.

Viewers are watching 17% more video content through internet-connected TV devices in 2019 versus 2018, according to eMarketer research. Additionally, advertising revenues are rising. Market researcher Magna forecast in 2019 that domestic OTT ad revenues to reach $5 billion by 2020, double from their 2018 value.

"More streaming service offerings, such as Apple TV Plus, Disney+, and anticipated launches of NBC's Peacock and WarnerMedia's HBO Max, are likely to push additional consumers through these connected platforms and further drive up viewing hours in the coming years," Schackart says.

"With more than 80% of the market unsubscribed, global demand for streaming services appears healthy and there remains a lot of runway for global growth. That's why you're seeing Disney and these other companies get in the game."

| Company | Streaming Services Launch |

|---|---|

| Disney+ | November 2019 |

| WarnerMedia's HBO Max | May 2020 |

| NBCUniversal Peacock | July 2020 |

| Apple TV Plus | November 2019 |

| Quibi* | April 2020 |

| *New mobile app to stream short, 5- to 10-minute videos | |

"It's just harder for the traditional TV networks to compete with the technology companies that spend a lot of money on original content," Schackart says. "I don't think they disappear because they have such loveable iconic content like The Office, Seinfeld, Friends, there's going to be an audience for that. But they will also be interested in what's new."

A streaming-focused company like Netflix is pouring about two-thirds of its revenues right back into original content where even an iconic brand like Disney faces constraints on resources because of its legacy business models, Schackart says.

"We estimate that in 2020 Netflix is going to spend $18 billion on new shows. By comparison, Disney only has $10 billion of extra cash each year to decide how they want to invest across their whole business—theme parks, cruise ships, TV networks, and so on," he adds.

Cord cutters and "cord nevers"

Driving all this change, of course, is not just the technology. It is a change in the audience.

More than 5 billion people worldwide have mobile phones, and over half of these connections are smartphones.

Want to skip broadcast commercials? Want to binge watch whenever you want? Want to view a movie on a cell phone, laptop, or iPad?

"That's the direction we're heading and ultimately it's driven by the consumer," says analyst Breen. "It's the consumer saying to the content provider: 'This is how we're going to take the content from now on. So, you can make us happy and deliver it the way we want it—and we'll pay you for it.'"

The rapid expansion of next generation internet-connected TVs with built-in streaming services and easy access to apps like Netflix, Hulu, and Amazon is also making it easier for consumers to cut their broadcast TV or cable cord.

Roku, the leader in connected TVs with about a third of the U.S. market, saw a 60% year-over-year increase in customer-streaming hours to 11.7 billion, according to the company's Q4 earnings report released in February.

Roku and Amazon Fire TV – each with over 30 million active users—are expanding internationally bringing streaming services to Germany, the United Kingdom, and Brazil.

The share of homes without traditional cable that now watch local TV stations via a digital antenna has increased almost 50% over eight years, totaling 16 million homes as of May 2018, according to a Nielsen 2018 report.

In August 2019, research company eMarketer predicted nearly 25% of U.S. households will be cord-cutters by 2022.

"That's a pretty staggering figure and likely signals further change in consumer viewing habits with a growing number of 'cord nevers' given the increasing amount of streaming channel choices," says Schackart. "We believe 2020 will again prove to be a strong year for over-the-top video environment," he adds.