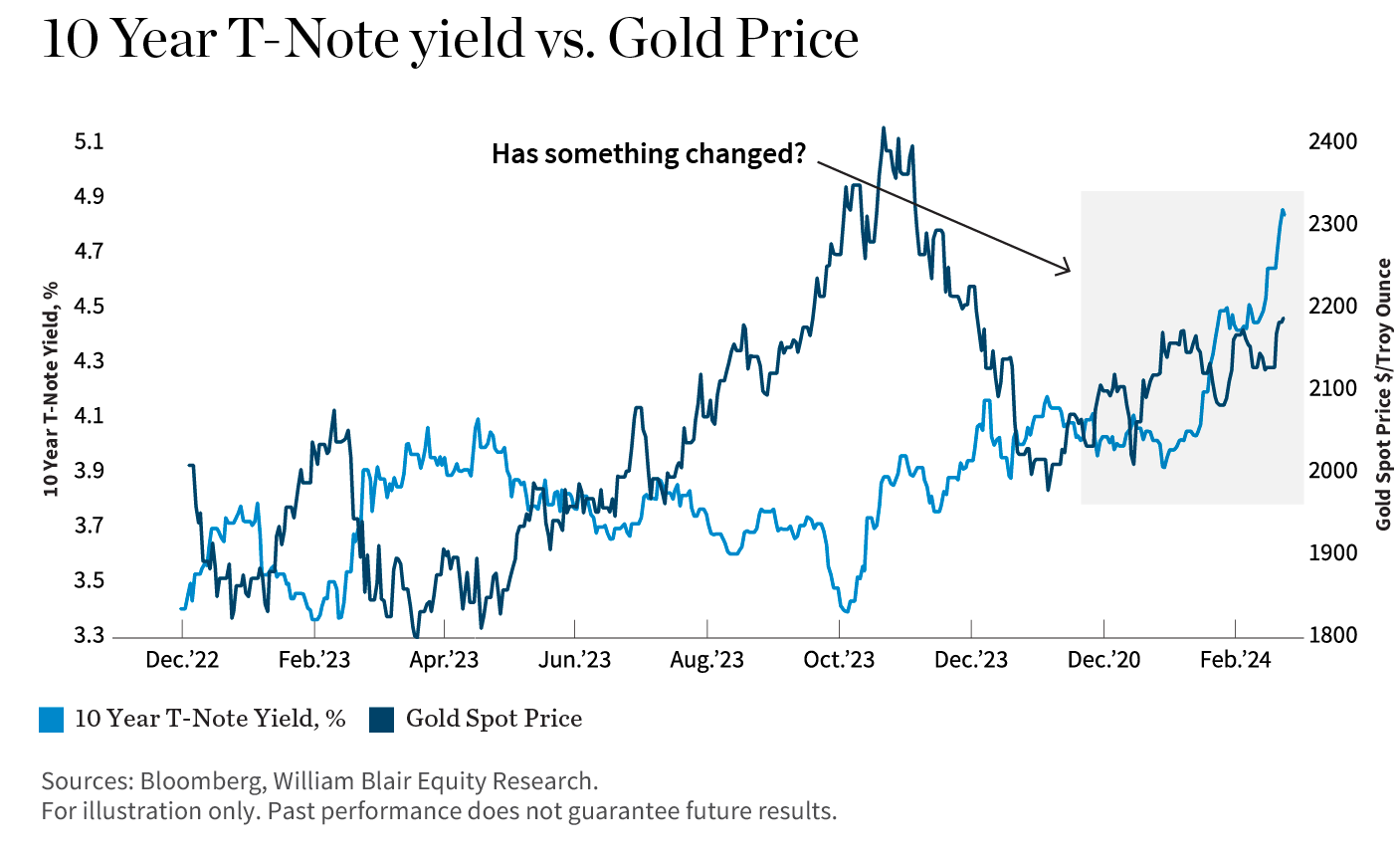

Thus far this year and particularly since the start of March, the price of gold has been hitting new highs simultaneously with bond yields rising. This relatively synchronized rise is curious because it has not been the norm for the last quarter century. Rather, from around 2000 onward, there had been a negative correlation between the direction of bond yields and the price of gold (or positive correlation between Treasury total returns and gold’s return). Yet, the move over the course of this year has been significant enough that it has justified the question of whether something fundamental has changed and what might be causing it.

One of the more obvious conclusions on the surface would be that U.S. growth is reaccelerating with no soft landing or hard landing. As a result, investors are becoming increasingly worried about what implications that might have for inflation and a possible return to a 1970s-1980s–style period of high inflation or stagflation.

Indeed, this could be a sensible conclusion when thinking about just the U.S. in a closed market. However, taking a wider global view of the situation and looking a little deeper below the surface reveals that there’s more to this than meets the eye.

For one thing, the rise in bond yields seems to be more of a reflection of a rising real yield and a rising term premium, on the back of stronger domestic growth, the market’s belief that future short rates may no longer need to be cut as much as previously anticipated, increased debt issuance, and, importantly, a shift in buyers away from price-insensitive foreign central banks toward more price-sensitive U.S. households.

Meanwhile, those foreign buyers are increasingly turning to gold as a store of value and safe haven against geopolitical tremors.

For more information on the research reports published by Richard de Chazal, please contact us or your William Blair representative.