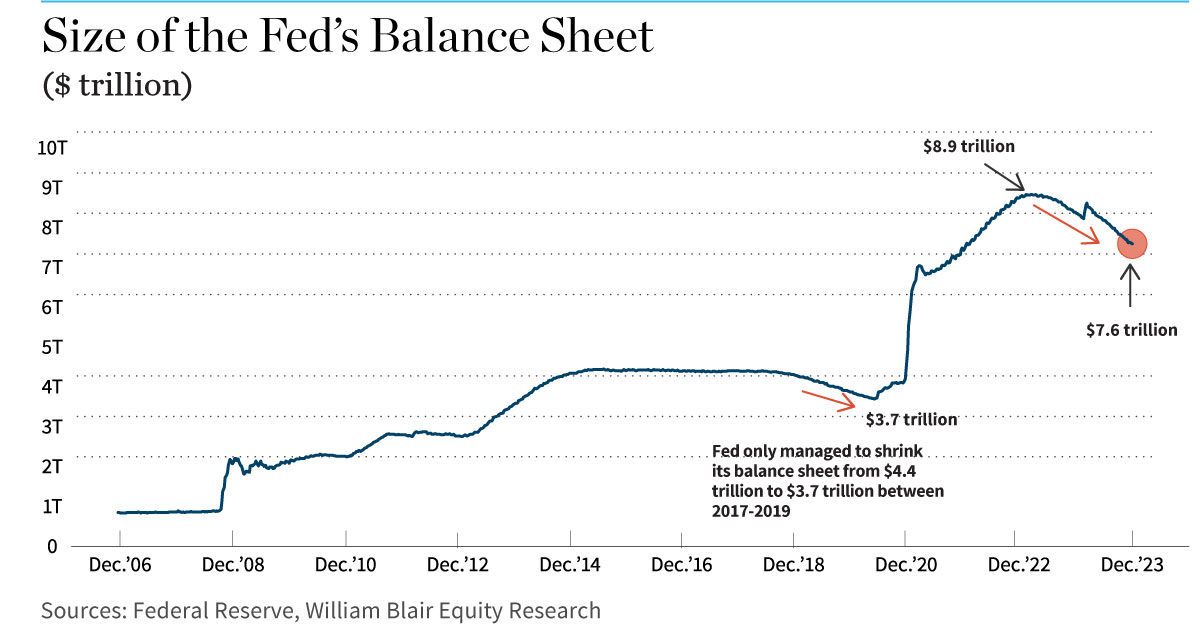

The minutes to the December FOMC meeting revealed some discussion around when to end quantitative tightening (QT). Subsequent to that, Dallas Fed President Lorie Logan (the likely instigator of the discussion at the FOMC meeting) broached this topic in her speech over the weekend to the AEA. That the Fed is already talking about ending QT when its balance sheet has only shrunk by $1.2 trillion (from $8.9 trillion to $7.6 trillion, exhibit 1), after having increased by close to $5 trillion since the start of the pandemic, may seem quite strange. In the attached report we delve into what has motivated this discussion on ending QT so soon and what gauges the Fed is using to decide how large its balance sheet ought to be.

Moving From Corridors to Floors

Everything changed for the Fed in 2008, when Chairman Bernanke successfully lobbied Congress to allow the Fed to pay interest on bank reserves and excess reserves. This is why the Fed’s balance sheet is unlikely to ever shrink back to its level pre-2008 (i.e., $800 billion) and why it now needs to have a large balance sheet.

Prior to 2008 the Fed was operating what was called a corridor system to achieve/manage its fed funds target rate. This corridor ceiling was made up of the discount rate (banks could borrow funds from the Fed’s slightly more expensive discount window if they needed them), and the floor was the effective fed funds rate (which was the interbank rate where banks could borrow funds from one another). The Fed would also conduct open market operations to maintain this target rate.

For the Fed to undertake QE—a process that floods the system with bank reserves when purchasing financial assets— it needed to ensure that it would still be able to control monetary policy and the policy rate in a world where banks were stuffed to the gills with excess reserves. After all, if banks have more reserves than they know what to do with, there’s no need to borrow or lend those reserves in the interbank market. The fed funds rate would then plunge to zero, and the market would disappear. This is effectively what has happened with the fed funds market today, where trading volumes have collapsed.

Without the power to control the flow of those reserves, the Fed would have no control over the main policy rate if/when it decided to raise rates to slow growth and inflation. Paying an interest rate on reserves held at the Fed allowed the Fed to limit the flow being borrowed/lent; after all, who would risk lending to another bank for a rate less than what the Fed was willing to pay it to sit on those reserves risk-free.

Crucially, paying interest on reserves and excess reserves effectively divorced the size of the Fed’s balance sheet from its monetary policy stance.

The problem with transitioning from a corridor to a floor system to manage the main policy interest rates for the Fed is that there have to be “ample” reserves in the system for the process to work effectively and smoothly.

The difficulty, of course, is knowing just the right level of reserves needed. In hoping to avoid the obvious method of simply waiting until something breaks in the financial markets—effectively what happened in 2019 with the repo market blowing up—the Fed is looking at a number of different gauges, including the size of reserve balances relative to GDP, which unfortunately is not an overly sensitive measure.

Dallas Fed President Lorie Logan has also fleshed out her thinking on this, suggesting a more fine-tuned approach should include watching volatility in the secured overnight financing rate (SOFR) and general collateral repo rates. The recent volatility here suggests liquidity is less plentiful than it has been since the Fed flooded the system following the pandemic, but still not tight. As a precaution, she proposes the Fed start to modestly reduce the rate of QT.

In slowing the balance sheet process and not being forced to do it via a market event, the Fed should be able to achieve greater balance sheet reduction over the longer term than would be the case otherwise.

Hence, despite the seemingly only modest amount of balance sheet reduction that has taken place relative to the $5 trillion expansion since 2019, in the coming FOMC meetings and Fed speeches, we should expect further discussion around this topic. The recent rhetoric from Logan and supporting data would be consistent with the start of slowing QT in the coming months and possibly ending it entirely by year-end—conveniently also when Janet Yellen will be thinking about reversing the Treasury’s “Operation Twist” and switching back to greater coupon debt issuance as opposed to T-bill issuance.

For more information on the research reports published by Richard de Chazal, please contact us or your William Blair representative.