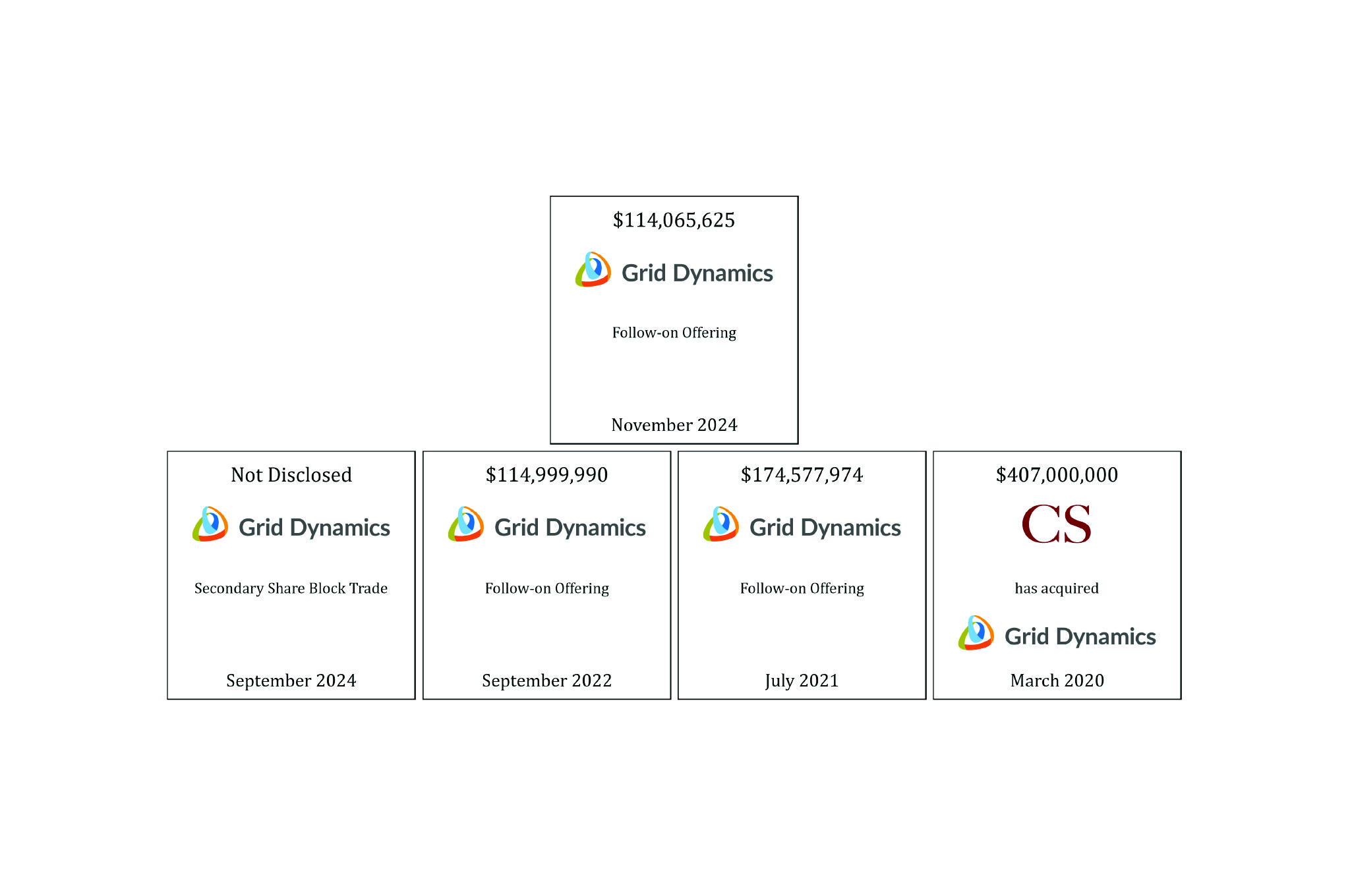

William Blair acted as an active bookrunner on the $114.1 million Follow-On Offering for Grid Dynamics Holdings, Inc. The transaction marks the fifth time William Blair has advised the company, a leading IT services firm that collaborates with Fortune 1000 clients to create digitally innovative products and experiences. The offering priced on November 12, 2024. Key transaction details are summarized below:

- The transaction was William Blair’s third active bookrun follow-on offering for the company after serving as De-SPAC Capital Markets Advisor in March 2020.

- The latest offering was an opportunistic raise following the company’s positive Q3 earnings release.

- William Blair executed two days of confidential marketing before transitioning to an overnight public follow-on.

- Stock appreciated 6.2% during confidential marketing and ultimately priced at $17.25 per share, a 9.8% file-to-offer discount.

- Participation was strong from new and existing long-only investors.

- The company intends to use the net proceeds from this offering for working capital, capital expenditures, and other general corporate expenses, as well as for M&A in complementary technologies or businesses.

We would be happy to further discuss the transaction as well as the current conditions in the U.S. equity capital markets and IT services sector. Please let us know if you are interested in scheduling a call with our team.

About the Companies

Grid Dynamics is a leading provider of technology consulting, platform and product engineering, AI, and digital engagement services. Fusing technical vision with business acumen, Grid Dynamics solves the most pressing technical challenges and enables positive business outcomes for enterprise companies undergoing business transformation. A key differentiator for Grid Dynamics is its 8 years of experience and leadership in enterprise AI, supported by profound expertise and ongoing investment in data, analytics, application modernization, cloud & DevOps, and customer experience. Founded in 2006, Grid Dynamics is headquartered in Silicon Valley with offices across the Americas, Europe, and India.

Learn more about our technology investment banking expertise.