In the first of a series of articles about trends shaping the investment and dealmaking landscape surrounding human capital solutions businesses, we examine the macro trends driving demand for outsourced and technology-enabled solutions for talent acquisition, talent management, and core HR and benefits services.

Today’s employment environment fundamentally differs from that of a decade ago. A confluence of economic, demographic, and regulatory forces have transformed the way companies source and manage their workforces. The landscape is characterized particularly by a long-term externalization of traditional corporate human resources (HR) functions, and the parallel development of a robust ecosystem of highly specialized service providers and technologies to serve talent needs. This third-party “employment infrastructure” sits at the core of how most businesses fill their talent needs and perform their HR functions today.

In a labor market defined by rapid employee turnover, scarcity of skilled talent, and mounting regulatory compliance burdens on employers, companies are increasingly using third-party HR services providers and innovative technology to meet these challenges and ensure that they aren’t falling behind in the race for talent. This, in turn, has led to rising interest from venture investors, financial sponsors, and strategic buyers in HR services and technology. This is true across the human capital solutions ecosystem—talent acquisition, talent management, and core HR and benefits—but investment and acquisition interest has been particularly robust in areas such as third-party recruiting and staffing for highly skilled positions, employee engagement and training platforms, professional employer organizations, and benefits management.

Across the employment lifecycle, economic, demographic, and regulatory pressures are forcing companies of all sizes to look for ways to manage their workforces more efficiently. Today, these solutions often involve working with third-party experts and technology-enabled platforms.

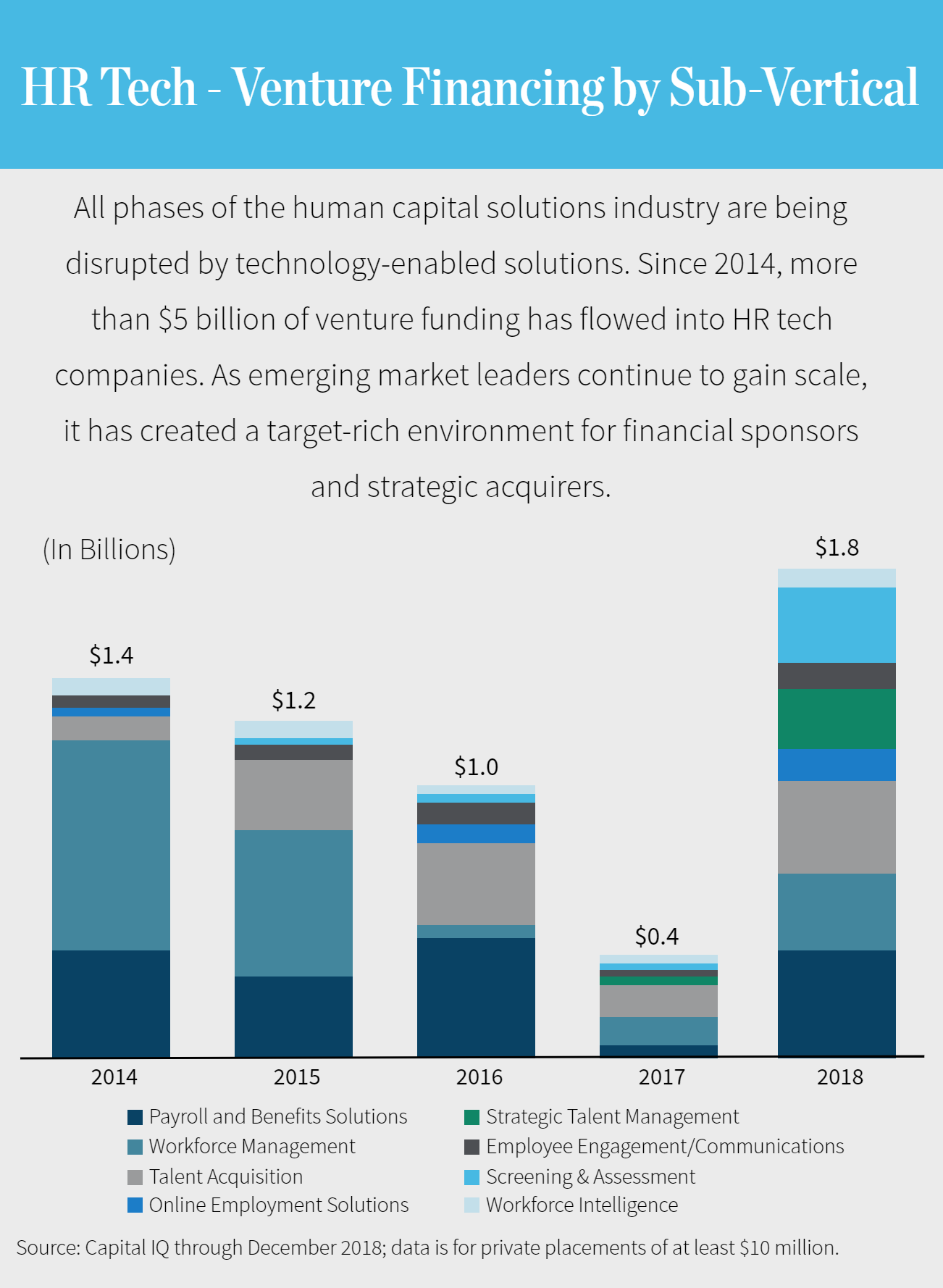

Across the industry, companies that are leveraging technology tools such as automation, artificial intelligence (AI), machine learning, mobile applications, and other tools are attracting the greatest interest from investors. Since 2014, HR tech companies have raised more than $5 billion of venture capital, leading to the emergence of new sub-verticals and market leaders that are quickly gaining scale.

This has created a target-rich environment for financial sponsors and strategic acquirers alike. Across the broader technology industry, acquisitions by financial sponsors outnumbered acquisitions by strategic buyers in both 2017 and 2018. This phenomenon is playing out in the HR tech sector as well; most large private equity firms have formed an investment thesis around the human capital solutions industry, attracted by the secular trends described above and high levels of recurring revenue.

Fourth-quarter activity by strategic buyers was headlined by Paychex’s $1.2 billion acquisition of Oasis Outsourcing Acquisition Corp., a provider of HR and employee-benefits services for small and midsize businesses, and LinkedIn’s acquisition of Glint, a platform for gathering feedback about employee engagement.

HR Tech – Venture Financing by Sub-Vertical

All phases of the human capital solutions industry are being disrupted by technology-enabled solutions. Since 2014, nearly $6 billion of venture funding has flowed into HR tech companies. As emerging market leaders continue to gain scale, it has created a target-rich environment for financial sponsors and strategic acquirers.

All phases of the human capital solutions industry are being disrupted by technology-enabled solutions. Since 2014, more than $5 billion of venture funding has flowed into HR tech companies. As emerging market leaders continue to gain scale, it has created a target-rich environment for financial sponsors and strategic acquirers.

Against this backdrop, we examine three powerful trends that are driving the growth and evolution of the human capital solutions industry.

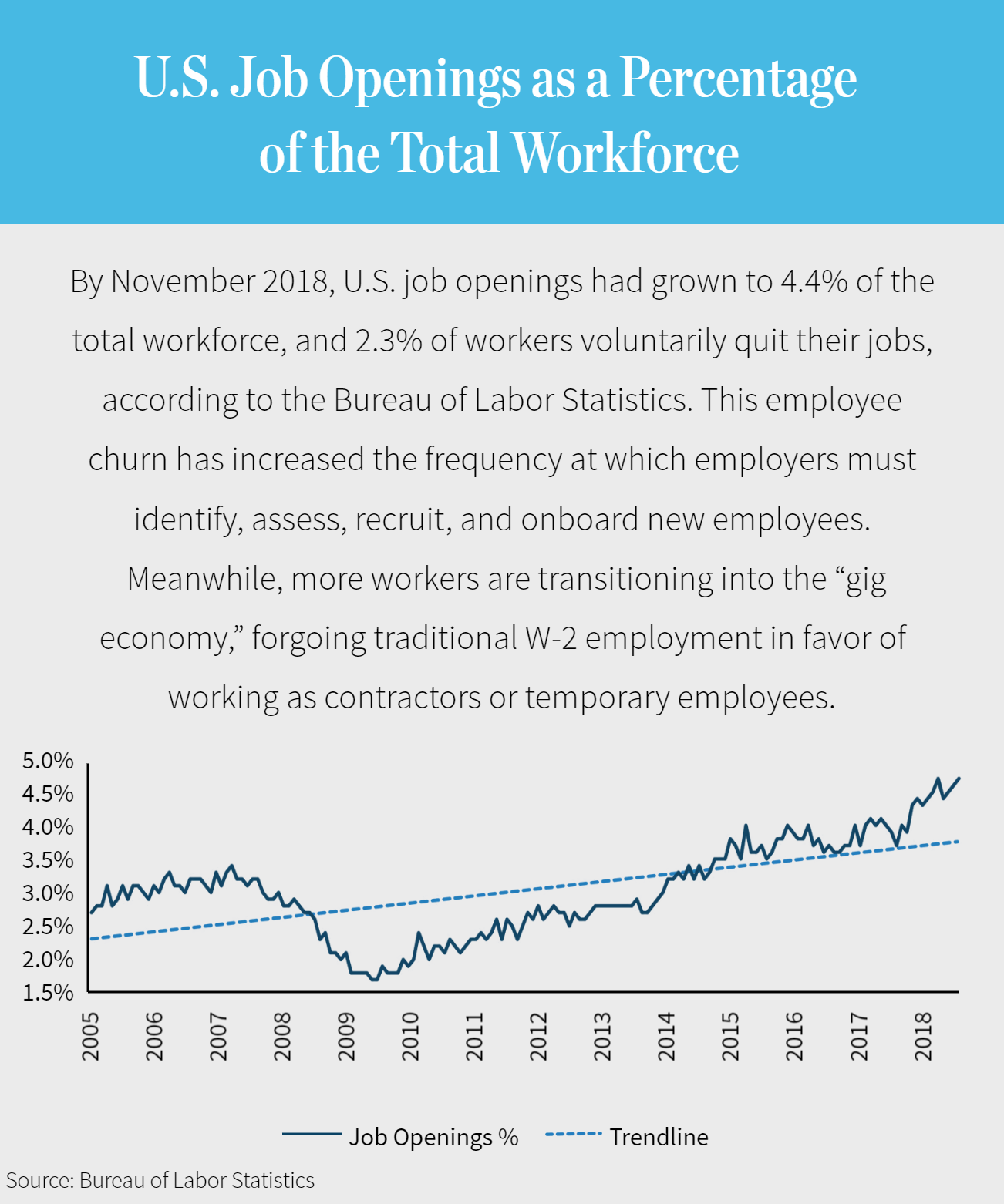

Increasing Velocity of Employment and the Growth of the Gig Economy

In an increasingly tight labor market with higher employee turnover, employers have to work harder to fill positions—and keep them filled. In this environment, the ability to recruit, screen, onboard, train, and engage workers efficiently is a true competitive differentiator.

By November 2018, U.S. job openings had grown to 4.4% of the total workforce, and 2.3% of workers voluntarily quit their jobs, according to the Bureau of Labor Statistics. This employee churn has increased the frequency at which employers must identify, assess, recruit, and onboard new employees. Meanwhile, more workers are transitioning into the “gig economy,” forgoing traditional W-2 employment in favor of working as contractors or temporary employees.

Generational, technological, and regulatory forces all drive the increasing velocity of employment. In addition to shifting attitudes and career priorities among millennials and younger workers, increased access to alternative sources of healthcare benefits and increasing popularity of gig work platforms such as Uber and Upwork—the latter of which completed its highly publicized IPO in October 2018—have made it easier for individuals to create financially viable careers one gig at a time.

To deal with higher workforce turnover, employers are relying on expert third-party service providers and technology that can increase efficiency for filling roles—and for keeping those positions filled. On the front end, there has been steadily increasing demand for services related to recruitment process outsourcing, staffing, recruitment marketing, candidate relationship management, screening and assessment, and onboarding.

Companies are also investing in services and tools to retain their existing workers as well as rethinking their approaches to performance management and training. The focus of performance management has shifted from completing annual reviews to enhancing employee engagement by recognizing achievement and providing feedback on a real-time basis.

The growing importance of employee recognition was a major value driver for HALO Branded Solutions. In June 2018, William Blair advised HALO, a leading provider of employee recognition solutions and branded merchandise, on its sale from Audax Private Equity to TPG Growth. Similarly, ADP’s desire to expand its talent-management capabilities led it to acquire The Marcus Buckingham Company, a pioneer in using data to improve employee engagement across teams, in 2017.

Growing Scarcity of Skilled Talent

While the U.S. labor market is tight across the board, employers are having an especially hard time filling roles for highly skilled technical positions—the kinds of positions that are seeing the greatest growth in today’s knowledge-driven economy. To address this skills gap, employers are seeking to partner with third-party staffing and recruiting providers that have cultivated extensive talent networks and relationships in highly specialized niches.

From an M&A perspective, staffing and recruiting firms that focus on highly skilled segments of the labor market are achieving the highest valuations in the sector. This was a powerful value driver for Vaco, which William Blair advised on its sale to Olympus Partners in November 2017. Vaco maintains a strong presence in many of the hardest-to-fill roles, including healthcare IT and other forms of specialized IT, and senior-level accounting and finance positions.

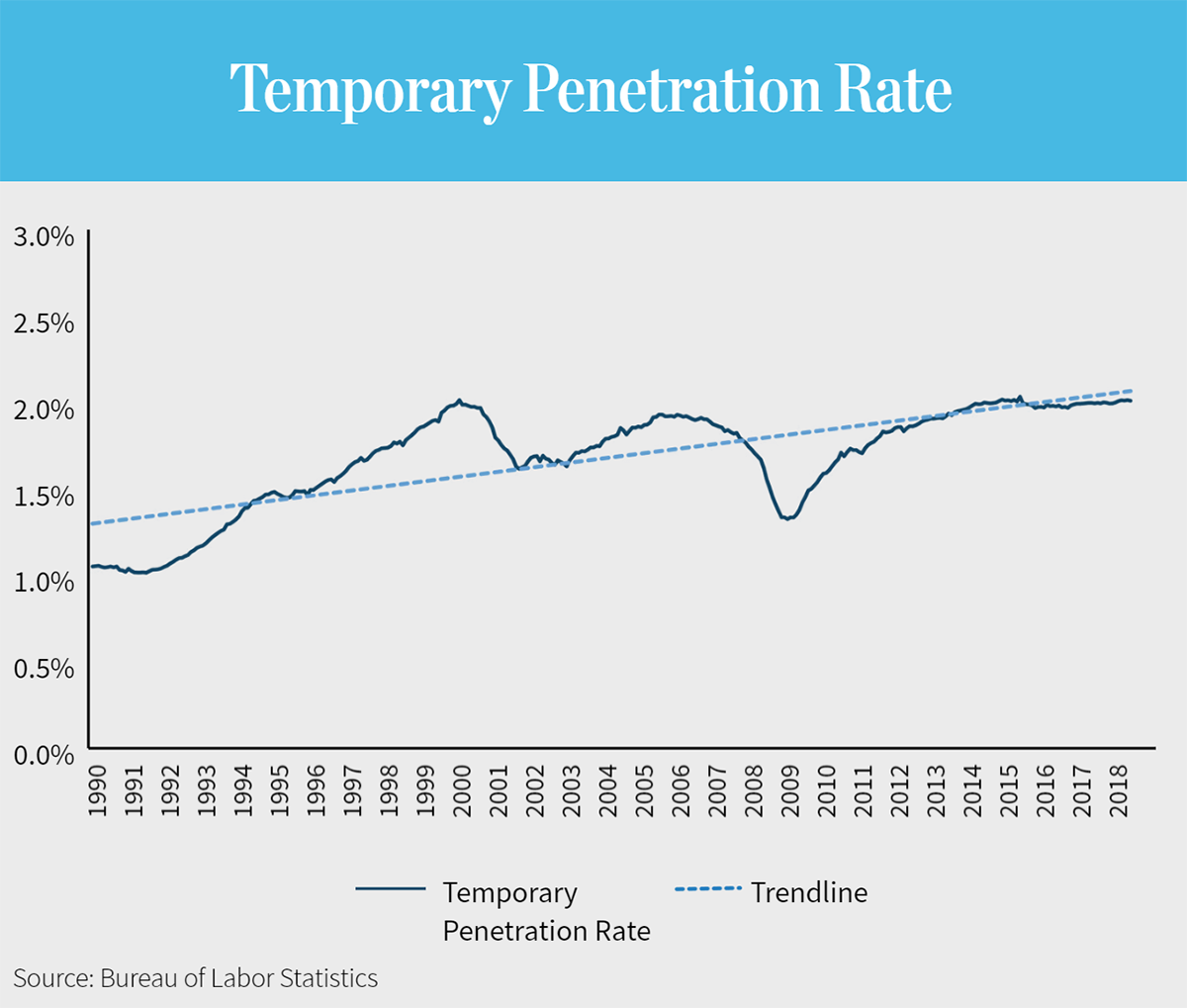

Much of the supply-demand imbalance for skilled workers is being addressed through an increased reliance on temporary workers and other forms of contingent workforces. One measure of the use of temporary workers is the “temp penetration rate,” the percentage of the total U.S. workforce employed in temporary positions. While this metric has varied at different points in economic cycles, over the long term this rate has more than doubled, regardless of economic conditions, indicating the emergence of a significant structural element of temporary workers in the broader economy. Temporary workers alone now account for more than 2% of the total workforce, an all-time high, according to the Bureau of Labor Statistics.

William Blair advised Beeline, whose cloud-based vendor management platform helps employers manage their contingent workforces, on its sale to New Mountain Capital in July 2018. As a leading vendor management provider for the contingent workforce, Beeline is vendor neutral across staffing firms, enabling it to partner with a host of staffing providers across the market.

In addition to bringing in external talent through staffing and recruiting solutions, employers are trying to narrow the skills gap by offering enhanced training to their existing employees. This trend is occurring across the continuum of skills requirements. In May 2018, William Blair advised Penn Foster on its acquisition by Bain Capital Double Impact, the impact investing strategy of Bain Capital. Through its online and blended learning programs, Penn Foster offers affordable diploma, certificate, and degree programs primarily for middle-skilled workers (i.e., those in roles that usually don’t require a college degree).

Increasingly Complex Regulatory and Compliance Requirements

Employers in the United States must navigate a complex regulatory landscape. Healthcare reform, employment eligibility, workers compensation, W-2/1099 determination, wage and hour laws, and myriad industry-specific regulatory requirements make HR compliance expensive and time-consuming for employers of all sizes. This challenge is especially daunting for small and midsize businesses (SMBs).

Rather than managing all of this HR compliance burden themselves, more SMBs are turning to professional employer organizations (PEOs) and administrative service organizations (ASOs). These third parties can provide a full suite of core HR services on an outsourced basis, including payroll, benefits, insurance, and regulatory compliance. The number of workers employed by PEOs in the United States grew at a compound annual growth rate of 8.3% from 2008 to 2017 to 3.7 million, according to the National Association of Professional Employer Organizations. This represents 12.1% of all employment by private sector employers that have between 10 and 99 employees (the size of company most likely to use PEOs).

The benefits piece of this equation can be particularly challenging for SMBs, and a smaller company’s inability to offer an attractive benefits package often puts it at a competitive disadvantage when hiring talent. As a result, many SMBs are turning to outside partners to design and administer benefits programs. Even for larger companies, outsourcing these tasks to a third party that specializes in benefits administration can add tremendous value—for the employer and for the workforce.

William Blair advised BenefitMall, a leading employee benefits and payroll services provider for SMBs, on its acquisition by The Carlyle Group in December 2017. Other benefits-focused providers that William Blair has advised include Businessolver, PlanSource, and Evolution1.

In subsequent articles, we will further explore the dealmaking and capital-raising trends in the three verticals that compose the broader human capital solutions industry: talent acquisition, talent management, and core HR and benefits.