All three major segments of the aerospace industry—commercial, cargo, and defense—are supported by positive macroeconomic tailwinds. The expansion of these markets is driving growth in industries that support aviation, including independent MRO providers that help to keep aircraft in service, provide major repair services, and convert aircraft from one use to another (e.g., from commercial to military or cargo use). The global aircraft MRO market totaled $135 billion in 2018 and is expected to grow at a strong rate over the next decade, according to Technavio.

Against this backdrop, there has been steady interest in MRO service providers, especially from financial sponsors. Carlyle Group's acquisition of StandardAero in April 2019 is an example of a recent transaction in the MRO space.

We examine three trends that are creating enhanced demand and opportunities for independent MRO shops within the global expansion of the aerospace industry.

All Segments Experience Market Tailwinds

Commercial: The commercial market is growing due to increased activity in emerging markets, particularly China, where commercial aviation is rapidly expanding. As air traffic increases globally, required in-service fleets will grow, leading to a corresponding increase in demand for maintenance and repair services. OEMs and commercial airlines will not have capacity for the entirety of this increase, and therefore will focus their maintenance and repair efforts primarily on newer platforms coming to market, providing opportunities for independent MRO companies.

Cargo: The cargo market is also growing, largely driven by the influence of e-commerce and direct-to-consumer shopping and the prevalence of decentralized supply chains. Cargo air traffic is expected to more than double over the coming 20 years. This growth is also increasing demand for MRO companies that service the legacy platforms that are commonly used for cargo, as well as for companies that provide services to convert commercial aircraft to cargo/freight aircraft.

Defense: An increasing U.S. defense budget is supportive of demand in the military aerospace market. Similar to the cargo market, conversions are common in the defense market. The average age of aircraft in the cargo and defense markets is projected to increase over the coming decade, and as those aircraft stay in service longer, independent MRO providers should see greater demand for their parts and technical expertise in servicing such aircraft.

OEM Focus on Newer Platforms Creates Growth Opportunity for Independent MRO Shops

To keep up with increasing demand for global aviation, many new aircraft platforms have recently been introduced to the market. As OEMs seek to increase their share of the aftermarket for newer aircraft platforms due to the associated profitability as well as quality control benefits of such work, independent MRO companies focused on legacy platforms should see significant white space for growth.

OEMs are focusing the bulk of their MRO efforts on newer platforms rather than legacy platforms for a number of reasons. Primary among these are simple capacity constraints—OEMs are limited in their ability to comprehensively service the entire spectrum of platforms due to the vast quantity of parts and technical expertise required to service both new and legacy platforms. Newer platforms represent a growing portion of commercial airline fleets. Commercial airlines are incentivized to adopt newer platforms to provide customers with newer aircraft with all of the latest conveniences, and newer platforms offer better fuel efficiency and safety features.

As commercial airlines and OEMs focus more attention on newer platforms coming to market, independent MRO companies that support legacy platforms should see increased demand for their parts inventory, services, and technical expertise. One of the attractive aspects of focusing MRO activities on legacy platforms is that the FAA mandates routine maintenance over the full life of these assets, providing consistent demand for service as platforms age.

Legacy platforms are especially attractive in the cargo and military markets, where less importance is placed on the age of platforms. (Unlike air travelers, packages don't have a preference regarding traveling on newer vs. older aircraft.) As demand for air cargo continues to grow due to strong demand from e-commerce, providers are interested in keeping legacy platforms in service as long as possible, which will require frequent shop visits and regular maintenance requirements, as mandated by government regulations and OEM guidelines.

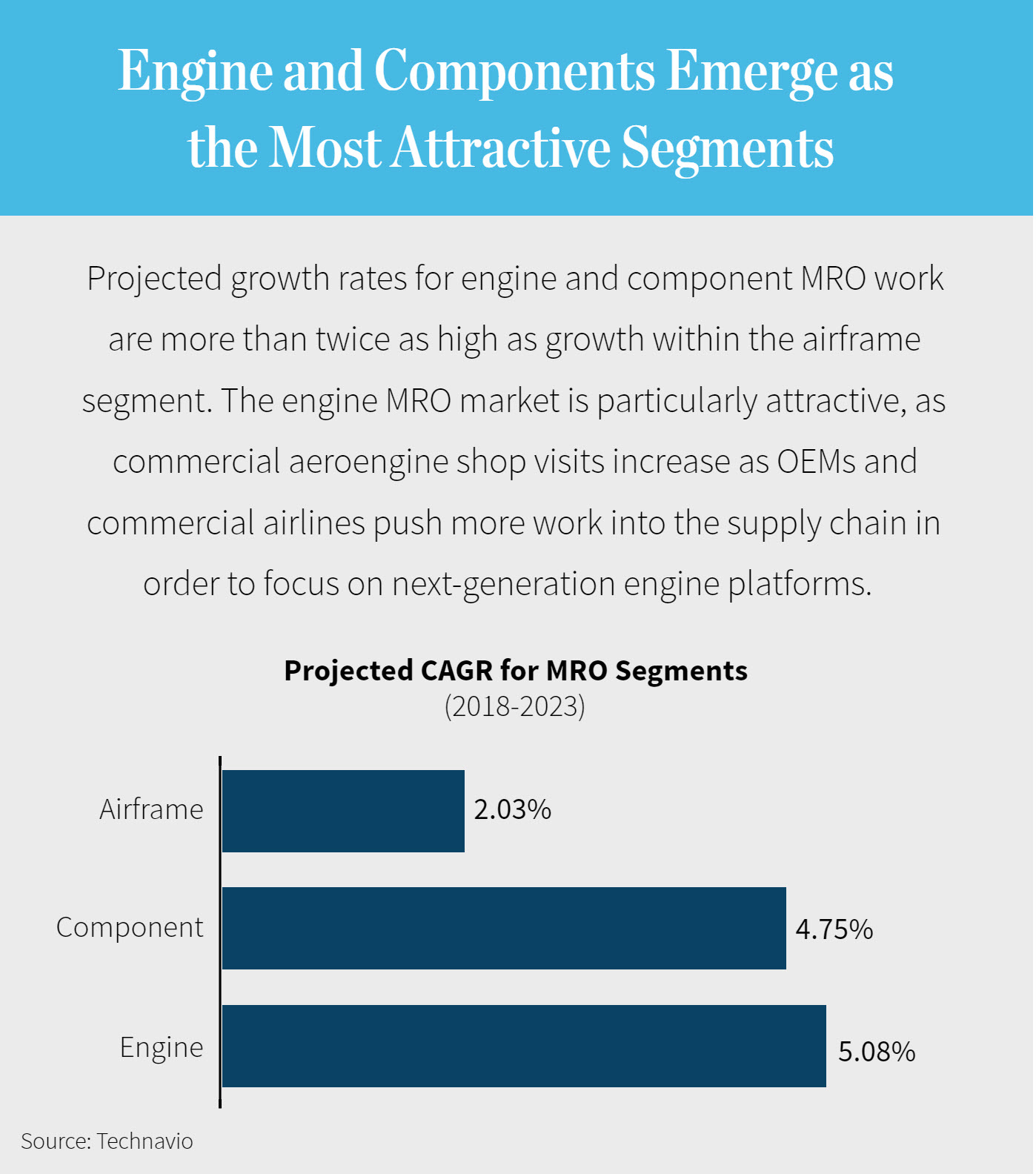

Component and Engine Segments Growing at Full Throttle

Engines represent the largest and fastest-growing segment of the MRO market. Commercial aeroengine shop visits are projected to increase for MRO providers as OEMs and commercial airlines push more work into the supply chain to focus on next-generation engine platforms. Several next-generation engines are projected to enter the market in the next decade, further limiting OEM capacity for mature engine MRO services.

MRO Providers Positioned to Capitalize on Market Trends

Independent MRO providers have greater flexibility to tailor service offerings to specific platforms. The legacy market also benefits from FAA regulations and OEM-specified requirements for mandatory maintenance intervals, providing strong visibility into regularly recurring revenue. In addition, barriers to entry are high in the aviation MRO market, due to a need for a highly sophisticated supply chain, the many certifications and approvals needed to operate, as well as the significant investment needed to develop complex capabilities and expertise.

To learn more about the trends shaping the dealmaking landscape in aerospace and defense, please don't hesitate to contact us.