Overview

The COVID-19 pandemic affected consumer behavior in myriad ways, including pet ownership. The large number of dogs, cats, and other animals added to families during the pandemic has accelerated opportunities for investors seeking to capitalize on this growth as well as the increasing humanization of pets. To help investors interested in the pet industry gain more insight into the opportunity set in pet treats and supplements, we examine the main drivers behind the industry’s strength and share takeaways from a recent survey we conducted about pet owner behavior. We also provide recommendations for how investors can seek to capitalize on these trends.

Key Takeaways

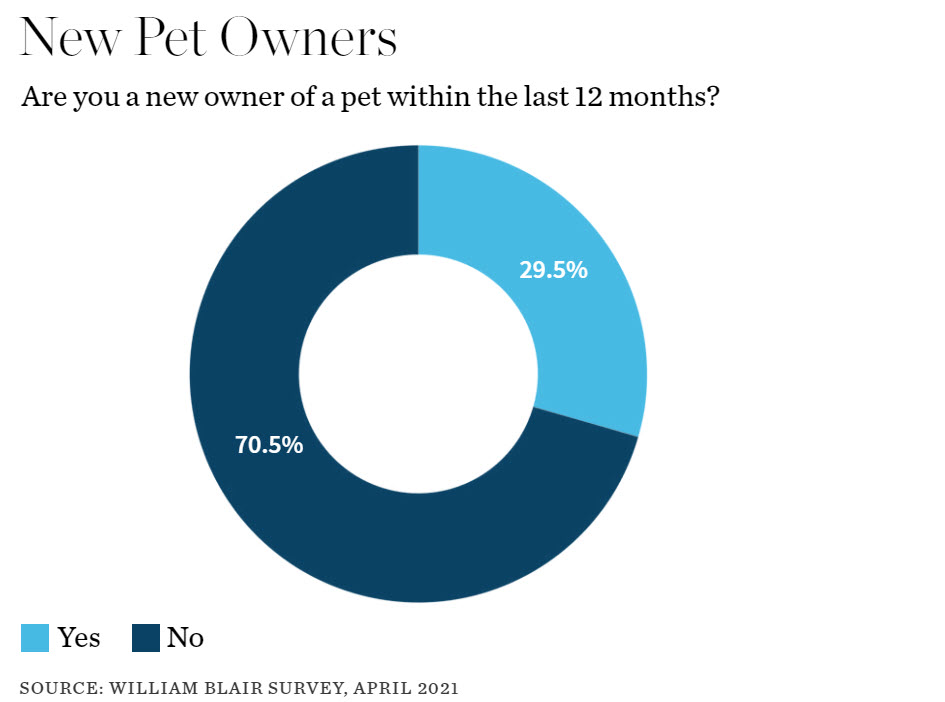

- Pet ownership — as well as the humanization of pets — is increasing. During the global lockdowns, many households decided to add a furry friend to their families, driving a significant increase in new pet ownership. According to William Blair’s survey of pet owners, nearly 30% of respondents reported they had adopted a new pet within the past 12 months and one-third are either highly or somewhat likely to adopt an additional pet in the next 12 months.

- The market for pet food, treats, and supplements is large and expanding. The American Pet Products Association (APPA) estimated that U.S. consumers spent a total of $103.6 billion on pets in 2020, a number that is anticipated to grow to $109.6 billion in 2021. The pet supplement segment appears to be growing the fastest — sales of pet supplements increased more than 20% in 2020.

- As consumers increasingly view their pets as members of the family, our survey of pet owners suggests that demand for premium products with more natural/better-for-you ingredients and other wellness benefits will continue to see surging demand. And this demand will be particularly robust for brands that effectively leverage e-commerce and direct-to-consumer channels.