The relentless expansion and maturation of the financial technology (FinTech) industry are reflected by the strong strategic and financial investor interest in the sector. We continue to see attention placed on the verticalization of payments, lending, and other services, as well as bank technology (BankTech) and regulation technology (RegTech).

Many of the transactions that William Blair's FinTech investment banking team has completed thus far in 2019 involved these themes. Based on that experience, as well as insight from our conversations with corporate development executives, business owners, and investors, we analyze the forces that are driving dealmaking and capital-raising activity across FinTech.

Verticalization of FinTech

Capital-raising and dealmaking activity in 2019 highlight the ongoing verticalization of the FinTech industry, a trend in which industry-focused software companies are increasingly leveraging elements of FinTech to help monetize their business models. While this trend is shaping growth strategies across FinTech, it is particularly impactful in payments and lending.

The integration of payment processing with vertical-specific software has resulted in strong deal activity focused on building platforms that can offer comprehensive, mission-critical capabilities for specific types of businesses. By focusing on providing essential software to manage operations in specific verticals, combined with payment monetization, companies can better understand customer needs and offer more tailored, relevant solutions. End-users also benefit from the verticalization of payments through a more seamless customer experience.

In 2019 there has been a steady stream of M&A activity driven by the verticalization and integration of payments. William Blair advised Transaction Services Group—a global revenue management solutions company that provides targeted business management software, integrated payments, and value-added services to clients in several sectors, including health and fitness and child care—on its sale to Advent International in June 2019. In July 2019, Silver Lake Partners acquired EverCommerce, a provider of technology solutions for business management and payment processing in the health services, home and field services, and fitness and wellness spaces. Earlier this year, Vista Equity Partners acquired MINDBODY, a leading technology platform for the fitness, beauty, and wellness services industries.

Several noteworthy capital raises have occurred in the software-led payments space in 2019. PayIt, a payments platform focused on public-sector entities, raised more than $100 million from Insight Partners in March 2019. In July, Finix announced a $17.5 million Series A funding round led by Bain Capital Ventures. Finix is a payments infrastructure platform that enables software companies to own, manage, and monetize their payments experience, accelerating the time it takes for a company to become a payments facilitator.

The verticalization trend is posing a major threat to horizontally oriented lending companies that focus on serving a broad range of end-markets. Vertically focused lenders are able to provide superior user experiences and financing services that are better aligned with the needs of specific types of users and transactions. Uplift, a start-up lender that provides financing for travel, raised $123 million in Series C funding led by Madrone Capital Partners in January 2019. Earnin, a start-up that provides users faster access to their paychecks and is viewed by some as an alternative to payday lenders, raised $125 million in Series C funding in December 2018 from DST Global, Andreessen Horowitz, Spark Capital, Matrix Partners, March Capital Partners, Coatue Management, and Ribbit Capital.

Square, which started as a horizontal player, has rapidly gained market share by expanding its offerings to include vertical-specific bundles that include both payments and lending. This year, Square launched Square Connect, which enables software providers to plug their services into Square to cater to specific verticals. Square also offers lending to its customers through Square Capital. By bundling offerings, Square can create greater retention among its customer base, transforming from just another payments service provider to delivering mission-critical software that drives customers' day-to-day operations. Stripe, a Square competitor, launched Stripe Capital in September 2019 to provide loans and merchant cash advances to Stripe users directly as well as through third-party partners.

BankTech

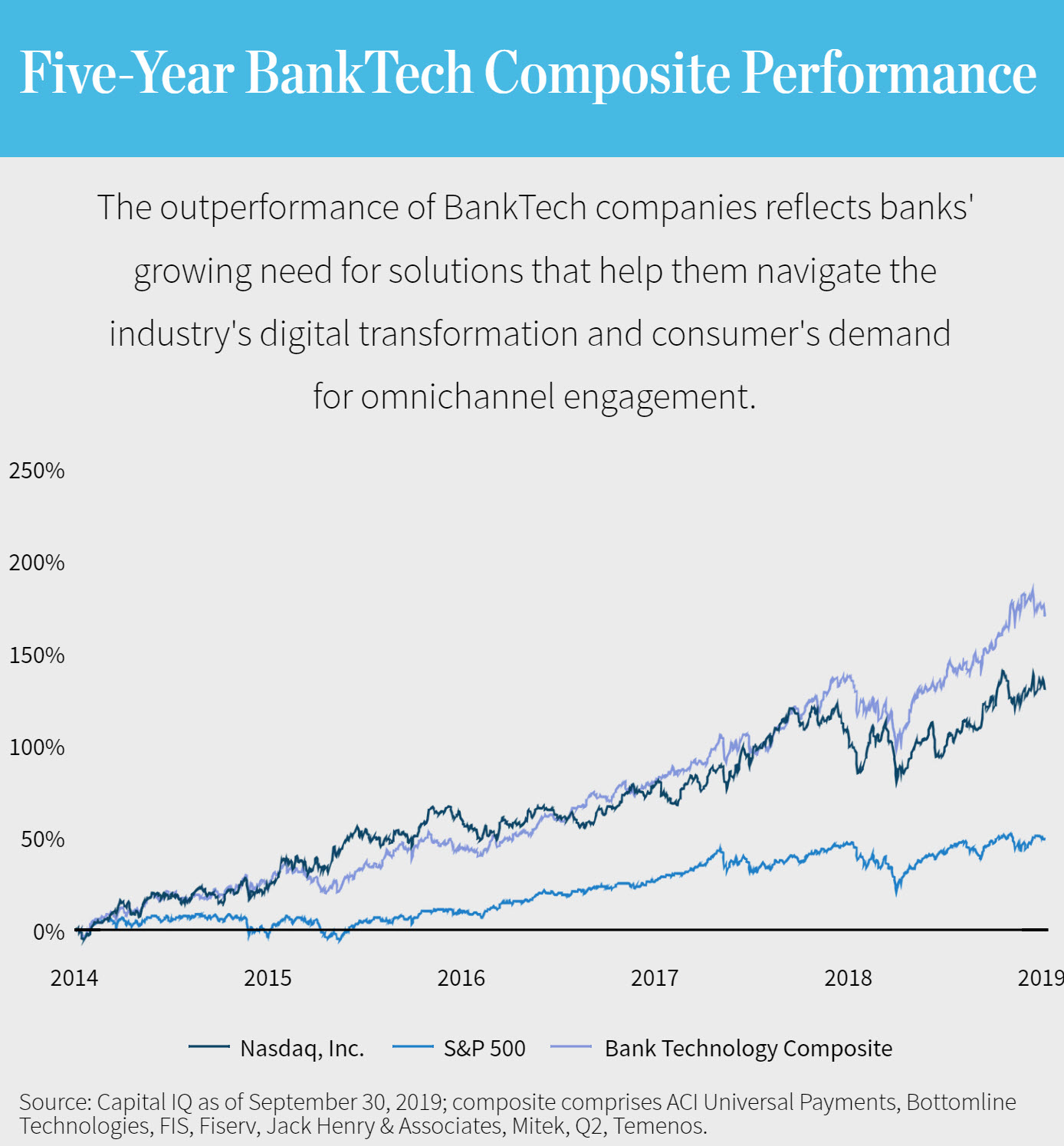

For banks, it is not a question of if, but how, to embrace digital transformation. Banks today must aggressively invest in technology to attract, retain, and grow customers, address an increasingly complex regulatory environment, improve operating efficiency, protect against security threats, and capitalize on data through the use of AI and machine learning.

Digital transformation provides exciting opportunities for banks to more proactively serve their customers with tailored products and services, as well as enhanced digital experiences. In particular, banks are focused on adding robust mobile capabilities that significantly enhance the convenience of core banking transactions and activities, including opening accounts, depositing checks, and sending money directly to friends and vendors.

Lending and big data are specific areas where banks are investing heavily in technology to replace legacy systems and improve workflows and processes. Machine learning is improving banks' ability to price loans, underwrite and onboard borrowers (including better processes around know-your-customer [KYC], anti-money laundering [AML], and compliance checks), and service their loan portfolios. In addition, banks are providing these services through enhanced interfaces and processes for the end-customer, creating a more enjoyable overall experience.

In October 2019, William Blair advised PrecisionLender—a data-driven SaaS-based company that provides sales enablement, pricing, and portfolio management solutions—on its sale to Q2 Holdings for $510 million. In October 2019, cloud banking company nCino raised an additional $80 million, bringing the company's total funding to over $213 million. nCino provides a Salesforce-based solution that helps banks to provide personalized onboarding, loan origination, and deposit account opening experiences. In March 2019, Abrigo, a tech-enabled provider of compliance, credit risk, and lending solutions for community banks, acquired Farin Financial Risk Management, a provider of advisory services and solutions that help financial institutions identify and manage interest rate risk and liquidity risk exposures.

In addition to advances in lending technology, banks are leveraging AI to improve other aspects of their business. AI has become a tool for delivering wealth management advice, customer service, and threat detection. Recent transactions that highlight these focus areas include Temenos's February 2019 acquisition of hTrunk, a big data and analytics solutions provider for banks, and nCino's July 2019 acquisition of Visible Equity, a provider of financial analytics and compliance software.

RegTech

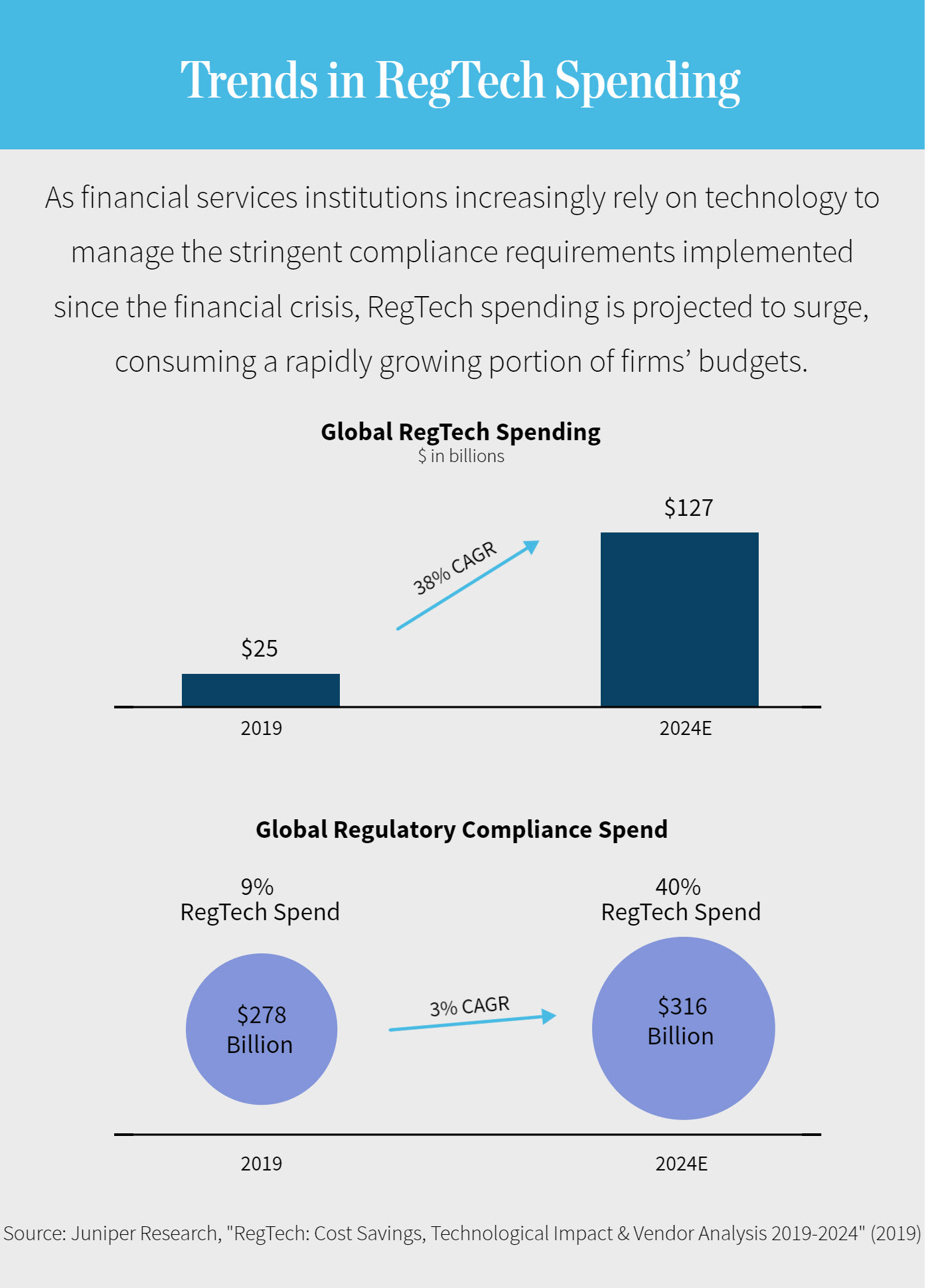

The regulation technology (RegTech) industry remains one of the fastest-growing segments of the broader governance, risk, and compliance (GRC) technology industry. Drastic increases in the number and complexity of regulations facing banks and other financial institutions since the financial crisis have fueled surging demand for technology-enabled solutions that allow companies to efficiently comply with these requirements. In addition to compliance with AML, KYC, and other regulations, financial institutions are increasingly relying on technology to manage payment risk and fraud prevention, tax management, portfolio and credit risk, predictive analytics, and trade and risk reporting. Juniper Research estimates that global RegTech spending will increase at a compound annual growth rate of 38% from 2019 to 2024 and go from representing 9% of total regulatory spending to 40% over that span.

Within the RegTech sector, compliance-focused technology is a particularly active space that is allowing for the automation of traditionally manual tasks. By leveraging technology to automate processes that formerly involved manual data entry, companies can greatly enhance their capabilities and realize attractive returns on investment. RegTech companies are enabling customers to automatically stay up-to-date with increasingly burdensome regulatory requirements. In addition, the quantity and complexity of regulations require reporting capabilities beyond what financial institutions can manage without specialized technology, which has led to the growth of RegTech companies focused specifically on improving reporting capabilities for financial institutions.

Powerful secular trends in the market, coupled with innovation from RegTech vendors, are driving collaboration between financial institutions, technology companies, and government agencies. Increasingly, RegTech providers are proactively partnering with both financial institutions and regulators to develop technology that is more robust and better aligned with the regulations' underlying objectives.

In July 2019, William Blair advised Confirmation on its sale to Thomson Reuters. Confirmation provides secure audit confirmation services designed to quickly and securely verify financial data for audit firms, banks, law firms, and credit firms. The acquisition helps Thomson Reuters provide customers with solutions that generate efficiencies, lower costs, improve accuracy, and reduce risks.

To learn more about the trends that are shaping the dealmaking and capital-raising environment in FinTech, please do not hesitate to contact us.